Claim Instructions

Claims System Modernization - New Montana Healthcare Programs Claims System Coming in 2027

The Department of Public Health and Human Services is pleased to announce we have contracted with Gainwell Technologies to implement a new system for processing and paying Montana healthcare claims. The claims project kicked off in October 2024, with plans to roll out the new system in 2027. For more information and to subscribe to receive updates to your inbox, please visit Claims Modernization on the DPHHS website.

New Provider Services Portal for Enrollment, Maintenance and Claims Entry available 12/13/2021.

Montana Healthcare Programs is excited to introduce a new Provider Services Module. Beginning December 13, 2021, you will notice a change to the online enrollment links. All providers seeking to enroll with Montana Healthcare Programs will be directed to the new MPATH online application offering a more efficient way to enroll, update information and easily submit claims!

MPATH Claims Entry Solution - The claims entry solution is an online tool allowing providers to manually enter claims. Available options include:

- Claim form templates - The system allows users to create and save templates for common claim submissions. No need to start from scratch every time.

- Diagnosis and Procedure code look up - The system has code look up features to assist with entering correct information.

- Ability to submit multiple claim types - including Professional, Facility and Dental claims.

- Great alternative to WinASAP5010 - The claims entry solution is a free, simple to use and providers can enter claims without converting and uploading files.

- Electronic Claim Adjustments - Paper adjustment forms are no longer required. The provider service module allows for online claim adjustments.

Provider Services Portal

There are two ways to submit claims to the Montana Healthcare Programs: Electronic and paper. Electronic claims are processed an average of 14 days faster than paper claims. Paper claims submitted via mail are processed an average of 12 days faster than paper claims submitted by fax. The information below is intended to support claim submission in both formats.

Billing Procedures

Claim Forms

Services provided by the healthcare professionals covered in this manual may be billed electronically or on paper claim forms, which are available from various publishing companies; they are not available from the Department or Provider Relations.

Timely Filing Limits (ARM 37.85.406)

Providers must submit clean claims to Montana Healthcare Programs within:

- Twelve months from whichever is later:

- the date of service

- the date retroactive eligibility or disability is determined

- Six months from the date on the Medicare explanation of benefits approving the service.

- Six months from the date on an adjustment notice from a third party payer who has previously processed the claim for the same service, and the adjustment notice is dated after the periods described above.

For claims involving Medicare or TPL, if the 12-month time limit has passed, providers must submit clean claims to Montana Healthcare Programs within:

- Medicare Crossover Claims. Six months from the date on the Medicare explanation of benefits, if the Medicare claim was timely filed and the member eligible for Medicare at the time the Medicare claim was filed.

- Claims Involving Other Third Party Payers (excluding Medicare). Six months from the date on an adjustment notice from a third party payer who has previously processed the claim for the same service, and the adjustment notice is dated after the periods described above.

Clean claims are claims that can be processed without additional information or action from the provider. The submission date is defined as the date that the claim was received by the Department or the claims processing contractor. All problems with claims must be resolved within this 12-month period.

Tips to Avoid Timely Filing Denials

- Correct and resubmit denied claims promptly. (See the Remittance Advices and Adjustments chapter in this manual.)

- If a claim submitted to does not appear on the remittance advice within 45 days, contact Provider Relations for claim status.

- If another insurer has been billed and 90 days have passed with no response, a provider can bill Montana Healthcare Programs . (See the Member Eligibility and Responsibilities chapter in this manual for more information.)

- To meet timely filing requirements for Medicare/Montana Healthcare Programs crossover claims, see the Member Eligibility and Responsibilities chapter in this manual and, if applicable, the Coordination of Benefits chapter in your provider type manual.

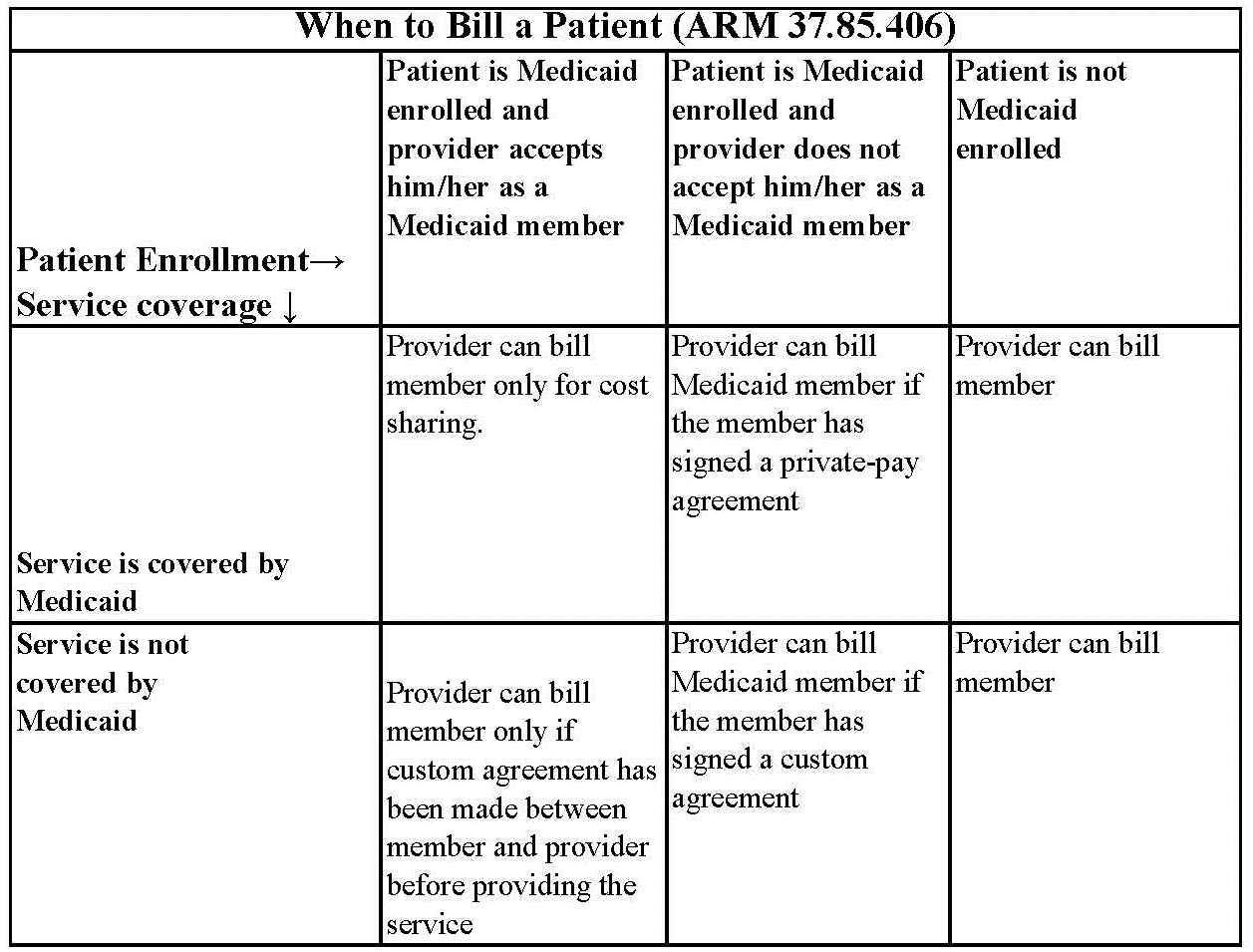

When to Bill Montana Healthcare Programs Members (ARM 37.85.406)

Providers may not bill Montana Healthcare Programs members for services covered under Montana Healthcare Programs .

If a provider bills Montana Healthcare Programs and the claim is denied because the member is not eligible, the provider may bill the member directly.

More specifically, providers cannot bill members directly:

- For the difference between charges and the amount Montana Healthcare Programs paid.

- For a covered service provided to a Montana Healthcare Program-enrolled member who was accepted as a Montana Healthcare Programs member by the provider, even if the claim was denied.

- When a third party payer does not respond.

- When a member fails to arrive for a scheduled appointment. Montana Healthcare Programs may not be billed for no-show appointments either.

- When services are free to the member, such as in a public health clinic. Montana Healthcare Programs may not be billed for those services either.

Exceptions are outlined in ARM 37.85.204.

Under certain circumstances, providers may need a signed agreement to bill a member.

Private-Pay Agreement. A nonspecific private-pay agreement between the provider and member stating that the member is not accepted as a Montana Healthcare Programs member, and that he/she must pay for the services received.

Custom Agreement. A specific agreement that includes the dates of service, actual services or procedures, and the cost to the member. It states the services are not covered by Montana Healthcare Programs and the member will pay for them.

Member Co-Payment (ARM 37.85.204)

Effective for claims paid on or after January 1, 2020, members covered under Montana Healthcare Programs or Medicaid Expansion will not be assessed a co-payment, as denied in ARM 37.84.102, for any covered service.

Billing for Members with Other Insurance

A Montana Healthcare Programs member may also be covered by Medicare or have other insurance, or some other third party is responsible for the cost of the member’s healthcare,

When completing a claim for members with Medicare and Montana Healthcare Programs , Medicare coinsurance and deductible amounts must correspond with the payer listed. For example, if the member has Medicare and Montana Healthcare Programs , any Medicare deductible and coinsurance amounts must be listed and preceded by an A1, A2, etc. Because these amounts are for Medicare, Medicare must be listed in the corresponding field. (See the Submitting a Claim section in this manual.)

Billing for Retroactively Eligible Members

When a member becomes retroactively eligible for Montana Healthcare Programs , the provider may:

- Accept the member as a Montana Healthcare Programs member from the current date.

- Accept the member as a Montana Healthcare Programs member from the date retroactive eligibility was effective.

- Require the member to continue as a private-pay member.

Always refer to the long descriptions in coding books.

When the provider accepts the member’s retroactive eligibility, the provider has 12 months from the date retroactive eligibility was determined to bill for those services. When submitting claims for retroactively eligible members in which the date of service is more than 12 months earlier than the date the claim is submitted, attach a copy of the Provider Notice of Eligibility (Form 160-M). To obtain this form, the provider should contact the member’s county Office of Public Assistance. See https://dphhs.mt.gov/hcsd/OfficeofPublicAssistance.

When a provider chooses to accept the member from the date retroactive eligibility was effective, and the member has made a full or partial payment for services, the provider must refund the member’s payment for the services before billing Montana Healthcare Programs for the services.

Coding Tips

Standard use of medical coding conventions is required when billing Montana Healthcare Programs . Provider Relations or the Department cannot suggest specific codes to be used in billing for services. See the Coding Resources table. The following may reduce coding errors and unnecessary claim denials:

- Use current CPT, CDT, HCPCS, and ICD diagnosis coding books.

- Always read the complete description and guidelines in the coding books. Relying on short descriptions can result in inappropriate billing.

- Attend classes on coding offered by certified coding specialists.

- Use specific codes rather than unlisted codes.

- Bill for the appropriate level of service provided. Evaluation and management services have 3 to 5 levels. See your CPT manual for instructions on determining appropriate levels of service.

- CPT codes that are billed based on the amount of time spent with the member must be billed with the code that is closest to but not over the time spent.

- Revenue Codes 25X are required to have valid and rebateable National Drug Codes (NDCs) on each line to be paid.

- Revenue Codes 27X do not require CPT or HCPCS codes; however, providers are advised to place appropriate NDC, CPT, and/or HCPCS codes on each line. Providers are paid based on the presence of line item CPT and HCPCS codes. If these codes are omitted, hospitals may be underpaid.

- Take care to use the correct units measurement. In general, Montana Healthcare Programs follows the definitions in the CPT and HCPCS coding books. Unless otherwise specified, one unit equals one visit or one procedure. For specific codes, however, one unit may be “each 15 minutes. A service must take at least 8 minutes to bill one unit of service if the procedure has “per 15 minutes” in its description. Always check the long text of the code description published in the CPT or HCPCS coding books.

Coding Resources

Please note that the Department does not endorse the products of any particular publisher.

CDT - http://www.ada.org/en/publications/

Description:

The CDT is the official coding used by dentists.

Contact:

American Dental Association

(312) 440-2500

CPT - https://commerce.ama-assn.org/store/

Description:

CPT codes and definitions.

Updated each January.

Contact:

American Medical Association

(800) 621-8335

CPT Assistant - https://commerce.ama-assn.org/store/

Description:

A newsletter on CPT coding issues.

Contacts:

American Medical Association

(800) 621-8335

HCPCS Level II

Description:

HCPCS codes and definitions.

Updated each January and throughout the year.

Contact:

Available through various publishers and bookstores or from CMS at www.cms.gov.

ICD

Description:

ICD diagnosis and procedure code definitions.

Updated each October.

Contact:

Available through various publishers and bookstores.

Various newsletters and other coding resources are available in the commercial marketplace.

Number of Lines on Claim

The Montana claims processing system supports 40 lines on a UB-04 claim, 21 lines on a CMS-1500, and 21 lines on a dental claim.

Multiple Services on Same Date

Outpatient hospital providers must submit a single claim for all services provided to the same member on the same day. If services are repeated on the same day, use appropriate modifiers. The only exception to this is if the member has multiple emergency room visits on the same date. Two or more emergency room visits on the same day must be billed on separate claims with the correct admission hour on each claim.

Span Bills

Outpatient hospital providers may include services for more than one day on a single claim, so long as the service is paid by fee schedule (e.g., partial hospitalization, therapies) and the date is shown on the line. However, the Outpatient Code Editor (OCE) will not price APC procedures when more than one date of service appears at the line level, so we recommend billing for only one date at a time when APC services are involved.

Reporting Service Dates

All line items must have a valid date of service. The revenue codes on the following page require a separate line for each date of service and a valid CPT or HCPCS code:

Revenue Codes That Require a Separate Line for Each Date of Service and a Valid CPT or HCPCS Code

26X - IV Therapy

28X - Oncology

30X - Laboratory

31X - Laboratory Pathological

32X -Radiology – Diagnostic

33X - Radiology – Therapeutic

34X - Nuclear Medicine

35X - Computed Tomographic (CT) Scan

36X - Operating Room Services

38X - Blood

39X - Blood Storage and Processing

40X - Other Imaging Services

41X - Respiratory Services

42X - Physical Therapy

43X - Occupational Therapy

44X - Speech-Language Pathology

45X - Emergency Department

46X - Pulmonary Function

47X - Audiology

48X - Cardiology

49X - Ambulatory Surgical Care

51X - Clinic

52X - Free-Standing Clinic

61X - Magnetic Resonance Imaging (MRI)

63X - Drugs Requiring Specific Identification

70X - Cast Room

72X - Labor Room/Delivery

73X - Electrocardiogram (EKG/ECG)

74X - Electroencephalogram (EEG)

75X - Gastro-Intestinal Services

76X - Treatment or Observation Room

77X - Preventive Care Services

79X - Lithotripsy

82X - Hemodialysis – Outpatient or Home

83X - Peritoneal Dialysis – Outpatient or Home

84X - Continuous Ambulatory Peritoneal Dialysis (CAPD) – Outpatient

85X - Continuous Cycling Peritoneal Dialysis (CCPD) – Outpatient

88X - Miscellaneous Dialysis

90X - Psychiatric/Psychological Treatments

91X - Psychiatric/Psychological Services

92X - Other Diagnostic Services

94X - Other Therapeutic Services

Using Modifiers

- Review the guidelines for using modifiers in the most current CPT book, HCPCS book, and other helpful resources (e.g., CPT Assistant, APC Answer Letter, and others).

- Always read the complete description for each modifier; some modifiers are described in the CPT manual while others are in the HCPCS book.

- Montana Healthcare Programs accepts most of the same modifiers as Medicare, but not all.

- The Montana Healthcare Programs claims processing system recognizes three pricing modifiers and one informational modifier per claim line on the CMS-1500. Providers are asked to place any modifiers that affect pricing in the first two modifier fields.

- Discontinued or reduced service modifiers must be listed before other pricing modifiers on the CMS-1500. For a list of modifiers that change pricing, see the How Payment Is Calculated chapter in this manual.

Billing Tips for Specific Services

Prior authorization is required for some services. Passport and prior authorization are different; some services may require both. Different numbers are issued for each type of approval and must be included on the claim form.

Abortions

A completed Montana Healthcare Programs Physician Certification for Abortion Services (MA-37) form must be attached to every abortion claim or payment will be denied. Complete only one section of this form. This is the only form Montana Healthcare Programs accepts for abortions.

Drugs and Biologicals

While most drugs are bundled, there are some items that have a fixed payment amount and some that are designated as transitional pass-through items. (See the Pass-Through section in the How Payment Is Calculated chapter of this manual.) Bundled drugs and biologicals have their costs included as part of the service with which they are billed. The following drugs may generate additional payment:

- Vaccines, antigens, and immunizations

- Chemotherapeutic agents and the supported and adjunctive drugs used with them

- Immunosuppressive drugs

- Orphan drugs

- Radiopharmaceuticals

- Certain other drugs, such as those provided in an emergency department for heart attacks

NDC Requirements

The Federal Deficit Reduction Act of 2005 mandates that all State Montana Healthcare Programs require the submission of National Drug Codes (NDCs) on claims submitted with certain procedure codes for physician-administered drugs. This mandate affects all providers who submit claims for procedure-coded drugs both electronically and manually.

Montana Healthcare Programs require all claims submitted for physician administered drugs to include the NDC(s), the corresponding CPT/HCPCS code(s), unit of measure, and the units administered for each code. Montana Healthcare Programs will only reimburse for drugs manufactured by companies that have a signed rebate agreement with the Centers for Medicare and Montana Healthcare Programs Services (CMS). A list of drug manufacturers who have a rebate agreement with CMS can be found on the provider website, https://medicaidprovider.mt.gov/, under the Rebateable Manufacturers list in the Site Index.

When a procedure or revenue code requires an NDC, Montana Healthcare Programs covers only those NDCs that are rebateable. An NDC is considered rebateable ONLY if all the following conditions are met:

-

The drug is a Montana Healthcare Programs covered drug

-

The NDC on the drug dispensed is valid

-

The drug dispensed is NOT terminated

-

The drug is a product of an eligible manufacturer

-

The DESI indicator is NOT 5 or 6.

NDC Formatting

When billing Montana Healthcare Programs, the required NDC is 11-digits. The NDC should be structured in the 5-4-2 format. Some manufacturers omit leading zeros in one of the three positions. This results in a 10-digit number, which is invalid. To ensure proper reimbursement, the provider must add the appropriate leading zero to the affected segment of the format.

The below table provides examples of where the leading zero should be placed in three separate instances.

NDC Example Conversion: 10 Digit to 11 Digit

Leading Zero Location Examples of 10 Digit Format: Add a zero (0) to:

5 digit segment XXXX-XXXX-XX 0XXXX-XXXX-XX

4 digit segment XXXXX-XXX-XX XXXXX-0XXX-XX

2 digit segment XXXXX-XXXX-X XXXXX-XXXX-0X

Reporting a NDC on paper CMS-1500, under Form Locator 24 (A) must included the following:

-

Enter the NDC qualifier of “N4” in the first two positions on the left side of the field.

-

Enter the 11-digit NDC numeric code in the 5-4-2 format, without the hyphens.

-

Enter the NDC unit of measure qualifier, such as:

-

F2 — International Unit

-

GR — Gram (includes mg, mcg)

-

ML — Milliliter

-

UN — Units (includes “each”)

-

-

Enter the NDC quantity (the administered amount) with up to three decimal places.

-

When using the paper CMS-1500, insert a space between the 11-digit NDC and the unit of measure.

Example only: N459148001665 ML0.8

Reporting a NDC on a paper UB-04, in Form Locator 43, in the Revenue Description Field must included the following:

-

Enter the NDC qualifier of “N4” in the first two positions on the left side of the field.

-

Enter the 11-digit NDC numeric code in the 5-4-2 format., without delimiters such as hyphens or commas

-

Enter the NDC unit of measure qualifier, such as:

-

F2 — International Unit

-

GR — Gram (includes mg, mcg)

-

ML — Milliliter

-

UN — Units (includes “each”)

-

-

Enter the NDC quantity (the administered amount) with up to three decimal places.

-

Any unused spaces for the entire quantity are left blank.

-

The Description Field allows for a maximum of 24 total characters.

Example only: N459148001665ML0.8

The NDC on the claim MUST be the NDC that was dispensed to the member. DO NOT include the name of the physician-administered drug when reporting the NDC.

Compound Drugs

Professional providers that bill compound drugs using the paper CMS-1500 must bill them using the corresponding CPT/HCPCS codes and NDC on paper claim forms and must attach the supplier’s invoice. The invoice must contain an NDC for each component of the compound. Invoices that do not include NDCs will be denied. Payment will be made from the NDCs listed on the invoices that qualify for rebates.

Crossover Claims

Dual-eligible claims billed to Medicare with an NDC will cross to Montana Healthcare Programs with the NDC. Any claim with a physician-administered drug crossing to Montana Healthcare Programs from Medicare without an NDC will be denied. Claims denied for this reason may be re-billed with the proper NDC within one year of the date of service.

340B Drug Pricing Programs or Vaccines

Providers participating in the 340B Drug Pricing Programs are not required to include NDC information on the claim. Vaccines do not require NDC information.

Lab Services

If all tests that make up an organ or disease organ panel are performed, the panel code should be billed instead of the individual tests.

Some panel codes are made up of the same test or tests performed multiple times. When billing one unit of these panels, bill one line with the panel code and one unit. When billing multiple units of a panel (the same test is performed more than once on the same day) bill the panel code with units corresponding to the number of times the panel was performed.

Outpatient Clinic Services

Montana Healthcare Programs does not recognize provider-based clinic status in reimbursing evaluation and management codes on the institutional claims (UB-04/8381) transactions. Clinic services provided by an individual physician or mid-level practitioner in the clinic must be billed on a CMS 1500 with place of service (POS) 11.

For services that have both technical and professional components, physicians providing services in hospitals must bill only for the professional component if the hospital is going to bill Montana Healthcare Programs for the technical component. Refer to the Physician-Related Services manual and the Billing Procedures chapter in this manual for more information. Provider type manuals are located on the provider type pages of the Provider Information website.

Partial Hospitalization

Partial hospitalization services must be billed with the national code for partial hospitalization, the appropriate modifier, and the prior authorization code.

Current Payment Rates for Partial Hospitalization

Code: H0035 Modifier: — Service Level: Partial hospitalization, sub-acute, half day

Code: H0035 Modifier: U6 Service Level: Partial hospitalization, sub-acute, full day

Code: H0035 Modifier: U7 Service Level: Partial hospitalization, acute, half day

Code: H0035 Modifier: U8 Service Level: Partial hospitalization, acute, full day

Sterilization/Hysterectomy (ARM 37.86.104)

Elective sterilizations are sterilizations done for the purpose of becoming sterile. Montana Healthcare Programs covers elective sterilization for men and women when all of the following requirements are met:

- Member must complete and sign the Informed Consent to Sterilization (MA-38) form at least 30 days, but not more than 180 days, prior to the sterilization procedure. This form is the only form Montana Healthcare Programs accepts for elective sterilizations. If this form is not properly completed, payment will be denied. The 30-day waiting period may be waived for either of the following:

- Premature Delivery. The Informed Consent to Sterilization must be completed and signed by the member at least 30 days prior to the estimated delivery date and at least 72 hours prior to the sterilization.

- Emergency Abdominal Surgery. The Informed Consent to Sterilization form must be completed and signed by the member at least 72 hours prior to the sterilization procedure.

- Member must be at least 21 years of age when signing the form.

- Member must not have been declared mentally incompetent by a federal, state, or local court, unless the member has been declared competent to specifically consent to sterilization.

- Member must not be confined under civil or criminal status in a correctional or rehabilitative facility, including a psychiatric hospital or other correctional facility for the treatment of the mentally ill.

Before performing a sterilization, the following requirements must be met:

- The member must have the opportunity to have questions regarding the sterilization procedure answered to his/her satisfaction.

- The member must be informed of his/her right to withdraw or withhold consent anytime before the sterilization without being subject to retribution or loss of benefits.

- The member must be made aware of available alternatives of birth control and family planning.

- The member must understand the sterilization procedure being considered is irreversible.

- The member must be made aware of the discomforts and risks which may accompany the sterilization procedure being considered.

- The member must be informed of the benefits and advantages of the sterilization procedure.

- The member must know that he/she must have at least 30 days to reconsider his/her decision to be sterilized.

- An interpreter must be present and sign for members who are blind or deaf, or do not understand the language to assure the person has been informed.

Informed consent for sterilization may not be obtained under the following circumstances:

- If the member is in labor or childbirth.

- If the member is seeking or obtaining an abortion.

- If the member is under the influence of alcohol or other substance which affects his/her awareness.

For elective sterilizations, a completed Informed Consent to Sterilization (MA-38) form must be attached to the claim for each provider involved or payment will be denied. This form must be legible, complete, and accurate. It is the provider’s responsibility to obtain a copy of the form from the primary or attending physician.

For medically necessary sterilizations, including hysterectomies, oophorectomies, salpingectomies, and orchiectomies, one of the following must be attached to the claim, or payment will be denied:

- A completed Montana Healthcare Programs Hysterectomy Acknowledgement form (MA-39) for each provider submitting a claim. It is the billing provider’s responsibility to obtain a copy of the form from the primary or attending physician. Complete only one section of this form. When no prior sterility (Section B) or life-threatening emergency (Section C) exists, the member (or representative, if any) and physician must sign and date Section A of this form prior to the procedure. (See 42 CFR 441.250 for the federal policy on hysterectomies and sterilizations.) Also, for Section A, signatures dated after the surgery date require manual review of medical records by the Department. The Department must verify that the member (and representative, if any) was informed orally and in writing, prior to the surgery, that the procedure would render the member permanently incapable of reproducing. The member does not need to sign this form when Sections B or C are used.

- For members who have become retroactively eligible for Montana Healthcare Programs , the physician must certify in writing that the surgery was performed for medical reasons and must document one of the following:

- The individual was informed prior to the hysterectomy that the operation would render the member permanently incapable of reproducing.

- The reason for the hysterectomy was a life-threatening emergency.

- The member was already sterile at the time of the hysterectomy and the reason for prior sterility.

When submitting claims for retroactively eligible members, for which the date of service is more than 12 months earlier than the date the claim is submitted, contact the member’s local Office of Public Assistance and request a Notice of Retroactive Eligibility (160-M). Attach the form to the claim.

Supplies

Supplies are generally bundled, so they usually do not need to be billed individually. A few supplies are paid separately by Montana Healthcare Programs . The fee schedules on the website lists the supply codes that may be separately payable.

Submitting a Claim

Paper Claims

Unless otherwise stated, all paper claims must be mailed to:

Claims Processing

P.O. Box 8000

Helena, MT 59604

On the CMS-1500, EPSDT/Family Planning, is used as an indicator to specify additional details for certain members or services. The following are accepted codes:

EPSDT/Family Planning Indicators

Code: 1 Member/Service: EPSDT

Purpose: Used when the member is under age 21.

Code: 2 Member/Service: Family planning

Purpose: Used when providing family planning services.

Code: 3 Member/Service: EPSDT and family planning

Purpose: Used when the member is under age 21 and is receiving family planning services.

Code: 4 Member/Service: Pregnancy (any service provided to a pregnant woman)

Purpose: Used when providing services to pregnant women.

Code: 6 Member/Service: Nursing facility member

Purpose: Used when providing services to nursing facility residents.

Submitting Electronic Claims

Providers who submit claims electronically experience fewer errors and quicker payment. Claims may be submitted using the methods below. For detailed submission methods, see the electronic submissions manual on the Electronic Billing page of the website.

- WINASAP 5010. This free software provided by Conduent allows for the creation of basic claim submissions. Please note that this software is not compatible with Windows 10 and has limited support as it is free software.

o Utilizes either a dial-up modem or submissions through the Montana Access to Health (MATH) Web Portal.

o Requires completion of the X12N Transaction Packet to allow for claim submissions.

- Clearinghouses/Contracted Claim Submitter. Providers can make arrangements with a clearinghouse/contracted claim submitter for claim submission. Please note that the clearinghouse must be enrolled to submit claims to Montana Healthcare Programs .

- Montana Access to Health (MATH) Web Portal. A secure website that allows providers to verify eligibility, check claim status, and view medical claims history. Valid X12N files can be uploaded through this website.

o Requires completion of the X12N Transactions Packet to allow for claim submissions.

- MoveIt DMZ. This secure transfer protocol is for providers and clearinghouses that submit large volumes of files (in excess of 20 per day) or are regularly submitting files larger than 2 MB. This utilizes SFTP and an intermediate storage area for the exchange of files.

o A request for this must be made through Conduent Provider Relations for established trading partners.

Providers should be familiar with federal rules and regulations related to electronic claims submission.

Billing Electronically With Paper Attachments

When submitting claims that require additional supporting documentation, the Attachment Control Number field must be populated with an identifier.

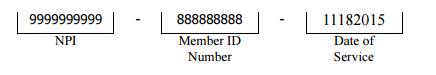

Identifier formats can be designed by software vendors or clearinghouses, but the preferred method is the provider's Montana Healthcare Programs ID number followed by the member's ID number and the date of service, each separated by a dash:

When submitting claims that require additional supporting documentation, the Attachment Control Number field must be populated with an identifier. Identifier formats can be designed by software vendors or clearinghouses, but the preferred method is the provider's Montana Healthcare Programs ID number followed by the member's ID number and the date of service, each separated by a dash:

The supporting documentation must be submitted with a Paperwork Attachment Cover Sheet. (See Forms page on the Provider Information website.) The number in the paper Attachment Control Number field must match the number on the cover sheet.

Claim Inquiries

Contact Provider Relations for general claim questions and questions regarding payments, denials, member eligibility.

The Most Common Billing Errors and How to Avoid Them

Paper claims are often returned to the provider before they can be processed, and many other claims, both paper and electronic, are denied. To avoid unnecessary returns and denials, double check each claim to confirm the following items are included and accurate.

Common Billing Errors

Reasons for Return or Denial: Provider’s National Provider Identifier (NPI) and/or Taxonomy is missing or invalid

How to Prevent Returned or Denied Claims:

- The provider NPI is a 10-digit number assigned to the provider by the national plan and provider enumerator system. Verify the correct NPI and Taxonomy are on the claim.

Reasons for Return or Denial: Authorized signature missing

How to Prevent Returned or Denied Claims:

- Each claim must have an authorized signature belonging to the provider, billing clerk, or office personnel. The signature may be typed, stamped, hand-written, or computer-generated.

Reasons for Return or Denial: Signature date missing

How to Prevent Returned or Denied Claims:

- Each claim must have a signature date.

Reasons for Return or Denial: Incorrect claim form used

How to Prevent Returned or Denied Claims:

- The claim must be the correct form for the provider type.

Reasons for Return or Denial: Information on claim form not legible

How to Prevent Returned or Denied Claims:

- Information on the claim form must be legible. Use dark ink and center the information in the form locator. Information must not be obscured by lines.

Reasons for Return or Denial: Member ID number not on file, or member was not eligible on date of service

How to Prevent Returned or Denied Claims:

- Before providing services to the member, verify member eligibility by using one of the methods described in the Member Eligibility and Responsibilities chapter of this manual. Montana Healthcare Programs eligibility may change monthly.

Reasons for Return or Denial: Procedure requires Passport provider referral – No Passport provider number on claim

How to Prevent Returned or Denied Claims:

- A Passport provider number must be on the claim form when a referral is required. Passport approval is different from prior authorization. See the Passport to Health provider manual.

Reasons for Return or Denial: Prior authorization number is missing

How to Prevent Returned or Denied Claims:

- Prior authorization is required for certain services, and the prior authorization number must be on the claim form. Prior authorization is different from Passport. See the Prior Authorization chapter in this manual.

Reasons for Return or Denial: Prior authorization does not match current information

How to Prevent Returned or Denied Claims:

- Claims must be billed and services performed during the prior authorization span. The claim will be denied if it is not billed according to the spans on the authorization.

Reasons for Return or Denial: Duplicate claim

How to Prevent Returned or Denied Claims:

- Check all remittance advices for previously submitted claims before resubmitting.

- When making changes to previously paid claims, submit an adjustment form rather than a new claim form. (See Remittance Advices and Adjustments in this manual.)

Reasons for Return or Denial: TPL on file and no credit amount on claim

How to Prevent Returned or Denied Claims:

- If the member has any other insurance (or Medicare), bill the other carrier before Montana Healthcare Programs .

- If the member’s TPL coverage has changed, providers must notify the TPL unit before submitting a claim.

Reasons for Return or Denial: Claim past 365-day filing limit

How to Prevent Returned or Denied Claims:

- The Claims Processing unit must receive all clean claims and adjustments within the timely filing limits described in this chapter.

- To ensure timely processing, claims and adjustments must be mailed to Claims Processing.

Reasons for Return or Denial: Missing Medicare EOMB

How to Prevent Returned or Denied Claims:

- All denied Medicare crossover claims must have an Explanation of Medicare Benefits (EOMB) with denial reason codes attached, and be billed to Montana Healthcare Programs on paper.

Reasons for Return or Denial: Provider is not eligible during dates of services, enrollment has lapsed due to licensing requirements, or provider number terminated

How to Prevent Returned or Denied Claims:

- Out-of-state providers must update licensure for Montana Healthcare Programs enrollment early to avoid denials. If enrollment has lapsed due to expired licensure, claims submitted with a date of service after the expiration date will be denied until the provider updates his or her enrollment.

- New providers cannot bill for services provided before Montana Healthcare Programs enrollment begins.

- If a provider is terminated from the Montana Healthcare Programs program, claims submitted with a date of service after the termination date will be denied.

- After updating his/her license, the claims that have been denied must be resubmitted by the provider.

Reasons for Return or Denial: Procedure is not allowed for provider type

How to Prevent Returned or Denied Claims:

- Provider is not allowed to perform the service.

- Verify the procedure code is correct using current HCPCS and CPT coding books.

- Check the appropriate Montana Healthcare Programs fee schedule to verify the procedure code is valid for your provider type.

Other Programs

The information in this chapter also applies to those services covered under the Mental Health Services Plan (MHSP).

End of Billing Procedures Chapter

Remittance Advices and Adjustments

The Remittance Advice

The remittance advice is the best tool providers have to determine the status of a claim. Remittance advices accompany payment for services rendered. The remittance advice provides details of all transactions that have occurred during the previous remittance advice cycle. Each line represents all or part of a claim and explains whether the claim or service has been paid, denied, or suspended/pending. If the claim was suspended or denied, the remittance advice also shows the reason.

Remittance advices are available electronically through the Montana Access to Health (MATH) web portal. To access the web portal and receive electronic remittance advices, providers must first complete an EDI Provider Enrollment Form and an EDI Trading Partner Agreement, and then register for the web portal.

Each provider must complete an EDI Trading Partner Agreement, but if there are several providers in one location who are under one tax ID number, they can use one submitter number. These providers should enter the submitter ID in both the provider number and submitter ID fields. Otherwise, enter the provider number in the provider number field.

After the forms have been processed, the provider receives a user ID and password to use to log into the MATH web portal. The verification process also requires a provider ID, a submitter ID, and a tax ID number.

Remittance advices are available in PDF format. Providers can read, print, or download PDF files using PDF reader software available online. Due to space limitations, each remittance advice is only available for 90 days. The remittance is divided into the following sections:

Remittance Advice Notice

This section is on the first page of the remittance advice. It contains important messages about rate changes, revised billing procedures, and many other items that may affect providers and claims.

Remittance advices are available for only 90 days on the web portal.

Paid Claims

This section shows claims paid during the previous cycle. It is the provider’s responsibility to verify that claims were paid correctly. If Montana Healthcare Programs overpays a claim and the problem is not corrected, it may result in an audit and the provider having to return the overpayment plus interest. If a claim was paid at the wrong amount or with incorrect information, the claim must be adjusted. (See the Adjustments section later in this chapter.)

Denied Claims

This section shows claims denied during the previous cycle. If a claim has been denied, refer to the Reason/Remark column. The Reason and Remark Code description explains why the claim was denied and is located at the end of the remittance advice. See the section titled The Most Common Billing Errors and How to Avoid Them in the Billing Procedures chapter.

Pending Claims

All claims that have not reached final disposition will appear in this area of the remittance advice (pended claims are not available on X12 835 transactions). The remittance advice uses suspended and pending interchangeably. They both mean that the claim has not reached final disposition. If a claim is pending, refer to the Reason/Remark Code column. The Reason and Remark Code description located at the end of the remittance advice explains why the claim is suspended. This section is informational only and no action should be taken on claims displayed here. Processing continues until each claim is paid or denied.

Claims shown as pending with reason code 133 require additional review before a decision to pay or deny is made. If a claim is being held while waiting for member eligibility information, it may be suspended for a maximum of 30 days. If Montana Healthcare Programs receives eligibility information within the 30-day period, the claim will continue processing. If no eligibility information is received within 30 days, the claim will be denied. When a claim is denied for lack of eligibility, the provider should verify that the correct Montana Healthcare Programs ID number was billed. If the ID number was incorrect, resubmit the claim with the correct ID number.

Credit Balance Claims

Credit balance claims are shown in this section until the credit has been satisfied.

Gross Adjustments

Any gross adjustments performed during the previous cycle are shown in this section.

Reason and Remark Code Description

This section lists the reason and remark codes that appear throughout the remittance advice with a brief description of each.

Credit Balance Claims

Credit balances occur when claim adjustments reduce original payments causing the provider to owe money to the Department. These claims are considered in process and continue to appear on the remittance advice until the credit has been satisfied. Credit balances can be resolved in two ways:

- By working off the credit balance. Remaining credit balances can be deducted from future claims. These claims will continue to appear on consecutive remittance advices until the credit has been paid.

- By sending a check payable to DPHHS for the amount owed. This method is required for providers who no longer submit claims to Montana Healthcare Programs. Please attach a note stating that the check is to pay off a credit balance and include your provider number. Send the check to the attention of the Third Party Liability unit.

Rebilling and Adjustments

Rebillings and adjustments are important steps in correcting any billing problems providers may experience. Knowing when to use the rebilling process versus the adjustment process is important.

Timeframe for Rebilling or Adjusting a Claim

Providers may resubmit, modify, or adjust any initial claim within the timely filing limits described in the Billing Procedures chapter.

The time periods do not apply to overpayments that the provider must refund to the Department. After the 12-month time period, a provider may not refund overpayments to the Department by completing a claim adjustment. The provider may refund overpayments by issuing a check or requesting a gross adjustment be made.

Rebilling Montana Healthcare Programs

Rebilling is when a provider submits a claim to Montana Healthcare Programs that was previously submitted for payment but was either returned or denied. Claims are often returned to the provider before processing because key information such as Montana Healthcare Programs provider number or authorized signature and date are missing or unreadable. For tips on preventing returned or denied claims, see the Billing Procedures chapter in this manual.

When to Rebill Montana Healthcare Programs

- Claim Denied. Providers may rebill Montana Healthcare Programs when a claim is denied. Check the reason and remark codes, make the appropriate corrections and resubmit the claim. Do not attempt to adjust denied claims.

- Line Denied. When an individual line is denied on a multiple-line claim, correct any errors and rebill Montana Healthcare Programs. For CMS-1500 claims, do not use an adjustment form. In the case of a UB-04, the line should be adjusted rather than rebilled. (See the Adjustments section.)

- Claim Returned. Rebill Montana Healthcare Programs when the claim is returned under separate cover. Occasionally, Montana Healthcare Programs is unable to process the claim and will return it to the provider with a letter stating that additional information is needed to process the claim. Correct the information as directed and resubmit the claim.

How to Rebill

- Check any reason and remark code listed and make corrections on a copy of the claim, or produce a new claim with the correct information.

- When making corrections on a copy of the claim, remember to line out or omit all lines that have already been paid.

- Submit insurance information with the corrected claim.

Adjustments

If a provider believes that a claim has been paid incorrectly, the provider may call Provider Relations. Once an incorrect payment has been verified, the provider should submit an Individual Adjustment Request form to Provider Relations. If incorrect payment was the result of a Conduent keying error, contact Provider Relations.

When adjustments are made to previously paid claims, the Department recovers the original payment and issues appropriate repayment. The result of the adjustment appears on the provider’s remittance advice as two transactions. The original payment will appear as a credit transaction. The replacement claim reflecting the corrections will be listed as a separate transaction and may or may not appear on the same remittance as the credit transaction. The replacement transaction will have nearly the same ICN number as the credit transaction, except the 12th digit will be a 2, indicating an adjustment. Adjustments are processed in the same time frame as claims.

When to Request an Adjustment

- Request an adjustment when the claim was overpaid or underpaid.

- Request an adjustment when the claim was paid but the information on the claim was incorrect (e.g., member ID, provider number, date of service, procedure code, diagnoses, units).

- Request an adjustment when an individual line is denied on a multiple-line UB-04 claim. The denied service must be submitted as an adjustment rather than a rebill.

How to Request an Adjustment

To request an adjustment, use the Individual Adjustment Request form available on the Forms page of the website. Requirements for adjusting a claim are:

- Adjustments can only be submitted on paid claims; denied claims cannot be adjusted.

- Claims Processing must receive individual claim adjustments within 12 months from the date of service. (See the Timely Filing section in the Billing Procedures chapter in this manual.) After this time, gross adjustments are required.

- Use a separate adjustment request form for each ICN.

- If correcting more than one error per ICN, use only one adjustment request form, and include each error on the form.

- If more than one line of the claim needs to be adjusted, indicate which lines and items need to be adjusted in the Remarks section.

Completing an Adjustment Request Form

- Download the Individual Adjustment Request form from the Provider Information website. Complete Section A with provider and member information and the claim’s ICN (see following table).

- Complete Section B with information about the claim. Remember to fill in only the items that need to be corrected (see following table):

- Enter the date of service or the line number in the Date of Service or Line Number column.

- Enter the information from the claim form that was incorrect in the Information on Statement column.

- Enter the correct information in the Corrected Information column.

- Attach copies of the remittance advice and a corrected claim if necessary.

- If the original claim was billed electronically, a copy of the remittance advice will suffice.

- If the remittance advice is electronic, attach a screen print of it.

- Verify the adjustment request has been signed and dated.

- Send the adjustment request to Claims Processing.

- If an original payment was an underpayment by Montana Healthcare Programs, the adjustment will result in the provider receiving the additional payment amount allowed.

- If an original payment was an overpayment by Montana Healthcare Programs, the adjustment will result in recovery of the overpaid amount from the provider. This can be done in two ways, by the provider issuing a check to the Department, or by maintaining a credit balance until it has been satisfied with future claims. (See Credit Balance earlier in this chapter.)

- Direct questions regarding claims or adjustments to Provider Relations.

Completing an Individual Adjustment Request Form

Section A

Field: 1. Provider Name and Address

Description: Provider’s name and address (and mailing address if different).

Field: 2. Name

Description: The member’s name

Field: 3. Internal Control Number (ICN)

Description: There can be only one ICN per Adjustment Request Form. When adjusting a claim that has been previously adjusted, use the ICN of the most-recent claim.

Field: 4. Provider number

Description: The provider’s NPI/API.

Field: 5. Member Montana Healthcare Programs Number

Description: Member’s Montana Healthcare Programs ID number.

Field: 6. Date of Payment

Description: Date claim was paid.

Field: 7. Amount of Payment

Description: The amount of payment from the remittance advice.

Section B

Field: 1. Units of Service

Description: If a payment error was caused by an incorrect number of units, complete this line.

Field: 2. Procedure Code/NDC Revenue Code

Description: If the procedure code, NDC, or revenue code are incorrect, complete this line.

Field: 3. Dates of Service (DOS)

Description: If the date of service is incorrect, complete this line.

Field: 4. Billed Amount

Description: If the billed amount is incorrect, complete this line.

Field: 5. Personal Resource (Nursing Facility)

Description: If the member’s personal resource amount is incorrect, complete this line.

Field: 6. Insurance Credit Amount

Description: If the member’s insurance credit amount is incorrect, complete this line.

Field: 7. Net (Billed - TPL or Medicare Paid)

Description: If the payment error was caused by a missing or incorrect insurance credit, complete this line. Net is billed amount minus the amount TPL or Medicare paid.

Field: 8. Other/Remarks

Description: If none of the above items apply, or if unsure what caused the payment error, complete this line.

Mass Adjustments

Mass adjustments are done when it is necessary to reprocess multiple claims. They generally occur when:

- Montana Healthcare Programs has a change of policy or fees that is retroactive. In this case federal laws require claims affected by the changes to be mass adjusted.

- A system error that affected claims processing is identified.

Providers are informed of mass adjustments on the first page of the remittance advice, the monthly Claim Jumper, or provider notices. Mass adjustment claims shown on the remittance advice have an ICN that begins with a 4.

Payment and the Remittance Advice

Montana Healthcare Programs payment and remittance advices are available weekly. Payment is via electronic funds transfer (EFT). Direct deposit is another name for EFT. The electronic remittance advices (ERAs) are available on the web portal for 90 days.

With EFT, the Department deposits the funds directly to the provider’s financial institution account. Holidays may delay payments until the next business day.

Other Programs

The information in this chapter also applies to the Mental Health Services Plan (MHSP), and Healthy Montana Kids (HMK) dental and eyeglasses benefits.

End of Remittance Advice and Adjustments Chapter

Whether you submit one claim a month or hundreds, any provider can benefit from switching from paper to electronic billing. Whether by using the free Provider Services Portal or by using a clearinghouse to submit claims, electronic billing is faster, more accurate, and more secure.

See Electronic Submission Setup below to begin the process.

For information about HIPAA 5010,visit the HIPAA5010 page on this website

Follow the steps below to submit your Medicaid claims electronically.

STEP 1

Download the electronic billing enrollment forms and instructions below. Complete and submit the forms to the address/fax number listed on the EDI enrollment form.

Clearinghouses or Billing Agents

EDI Submitter Enrollment Packet for X12N Transaction

All forms must be completed. To print individual sections, access the links below.

Individual Providers

EDI Submitter Enrollment Packet for X12N Transaction

Providers may omit sections 4a, 7b, and 8 Of the EDI Provider Enrollment Form. To print individual sections, access the links below.

STEP 2

Follow the steps in chapter 2 of the Provider Services Portal User Guide to register and set up your user access for the Provider Services Portal.

-

You must have completed the enrollment packet and received your welcome letter before using the Provider Services Portal for claims.

- For technical support, please contact Provider Relations at (800) 624-3958.

STEP 3

Login to the Provider Services Portal.

Under myMenu, without clicking, place your curser on Claims.

A side menu with submission options will appear.

Select the claims submission option you wish to use to submit claims using the free Provider Services Portal.

To bill claims electronically, a provider must enroll with EDI Solutions following the steps in the Electronic Submission Setup tab.

The Provider Services Portal is a web-based program hosted by MPATH and allows providers to submit directly to Medicaid without a software download.

If you have questions regarding the Provider Services Portal, please contact Provider Relations at (800) 624-3958.

Instructions for Billing Electronically

Paper Claim Instructions

Providers bill using their NPI and their taxonomy code or their atypical provider ID number.

CMS-1500 Claim Form Sample and Instructions

Instructions for Completing the UB-04

Instructions for Completing the 2019 Dental Claim Form

Electronic Claim Adjustments

Electronic Adjustments are now accepted by Montana Medicaid. There will be 2 options for submitting an electronic adjustment, depending on how the claim was originally submitted.

Acceptable frequency codes:

1 Indicates the claim is an original claim.

7 Indicates the new claim is a replacement or corrected claim – the information present on this claim represents a complete replacement of the previously issued claim.

8 Indicates the claim is a voided/canceled claim

Instructions for a Clearing House or Other Direct Submission Software

Create a new claim with the corrected information. If you are voiding the claim, claim information must match original claim.

All claim types

Loop 2300 - (CLM05-3) is the Claim Frequency Code. Enter 7 or 8.

REF*F8* - Enter the original ICN.

MPATH Claims Solutions

Create a new claim with the corrected information. If you are voiding the claim, claim information must match original claim.

Professional Claims (CMS-1500) & Dental Claims

Answer YES, to the first question at the bottom of the claim entry screen. The next two fields are now visible.

Select either Replacement of prior claim or Void of prior claim from the Medicaid Resubmission drop down.

Enter the Paid ICN of the claim being adjusted in the Original Reference Number field.

Institutional Claims (UB-04)

When recreating the claim, change the last digit of the Type of Bill code to either 7 for replacement or 8 for void.

The Original Reference Number filed is now visible. Enter the Paid ICN of the claim being adjusted in the Original Reference Number field.

November 2023 Billing 101 Training

Electronic Claim Adjustments

MPATH Provider Services Portal Claims Training Presentation

This is a portion of the January 2022 Provider Services Module training presentation. To view the entire training presentation, please see the Training Page.

Common Billing Errors

Paper claims are often returned to the provider before they can be processed, and many other claims, both paper and electronic, are denied. To avoid unnecessary returns and denials, double check each claim to confirm the following items are included and accurate.

| Reasons for Return or Denial | How to Prevent Returned or Denied Claims |

|---|---|

| Provider’s NPI and/or Taxonomy is missing or invalid | The provider NPI is a 10-digit number assigned to the provider by the national plan and provider enumerator system. Verify the correct NPI and Taxonomy are on the claim. |

| Authorized signature missing | Each claim must have an authorized signature belonging to the provider, billing clerk, or office personnel. The signature may be typed, stamped, hand-written, or computer-generated. |

| Signature date missing | Each claim must have a signature date. |

| Incorrect claim form used | The claim must be the correct form for the provider type. |

| Information on claim form not legible | Information on the claim form must be legible. Use dark ink and center the information in the form locator. Information must not be obscured by lines. |

| Member ID number not on file, or member was not eligible on date of service | Before providing services to the member, verify member eligibility by using one of the methods described in the Member Eligibility and Responsibilities chapter of this manual. Montana Healthcare Programs eligibility may change monthly. |

| Passport provider number is missing or invalid | A Passport provider number must be on the claim form when a referral is required. Passport approval is different from prior authorization. See the Passport to Health provider manual. |

| Prior authorization number is missing | Prior authorization is required for certain services, and the prior authorization number must be on the claim form. Prior authorization is different from Passport. See the Prior Authorization chapter in this manual. |

| Prior authorization does not match current information | Claims must be billed, and services performed during the prior authorization span. The claim will be denied if it is not billed according to the spans on the authorization. |

| Duplicate claim | Check all remittance advices for previously submitted claims before resubmitting. When making changes to previously paid claims, submit an adjustment form rather than a new claim form. (See Remittance Advices and Adjustments in this manual.) |

| TPL on file and no credit amount on claim | If the member has any other insurance (or Medicare), bill the other carrier before Montana Healthcare Programs. If the member’s TPL coverage has changed, providers must notify the TPL unit before submitting a claim. |

| Claim past 365-day filing limit | The Claims Processing unit must receive all clean claims and adjustments within the timely filing limits described in this chapter. To ensure timely processing, claims and adjustments must be mailed to Claims Processing. |

| Missing Medicare EOMB | All denied Medicare crossover claims must have an Explanation of Medicare Benefits (EOMB) with denial reason codes attached and be billed to Montana Healthcare Programs on paper. |

| Provider is not eligible during dates of services, enrollment has lapsed due to licensing requirements, or provider number terminated | Out-of-state providers must update licensure for Montana Healthcare Programs enrollment early to avoid denials. If enrollment has lapsed due to expired licensure, claims submitted with a date of service after the expiration date will be denied until the provider updates his or her enrollment. New providers cannot bill for services provided before Montana Healthcare Programs enrollment begins. If a provider is terminated from the Montana Healthcare Programs program, claims submitted with a date of service after the termination date will be denied. After updating his/her license, the claims that have been denied must be resubmitted by the provider. |

| Procedure is not allowed for provider type | Provider is not allowed to perform the service. Verify the procedure code is correct using current HCPCS and CPT coding books. Check the appropriate Montana Healthcare Programs fee schedule to verify the procedure code is valid for your provider type. |

Montana Medicaid reimburses only for drugs that are manufactured by companies that have a signed rebate agreement with CMS. An updated list of these manufacturers has been posted on the Site Index under Rebateable Manufacturers.

To determine if a manufacturer has signed a rebate agreement, check the first five digits of the National Drug Code (NDC) against the list. If there is no match, the drug is not reimbursable.

The list will be updated quarterly, so check regularly to assure coverage.

In addition, the valid NDC must be recorded on the claim (no spaces, no punctuation) as an 11-digit series of numbers. Claims will be denied for drugs billed without a valid 11-digit NDC. Providers also must be careful when entering the NDC quantity (the administered amount).

Numeric Codes for HIPAA Mandated Transactions and Their Descriptions

Transaction and Code Sets Regulations

EDI Solutions Website Links Updated

If you are having trouble finding information, contact Provider Relations via email at MTPRHelpdesk@conduent.com.