Nursing Facility and Swing Bed Manual

Printing the manual material found at this website for long-term use is not advisable. Department Policy material is updated periodically and it is the responsibility of the users to check and make sure that the policy they are researching or applying has the correct effective date for their circumstances.

If you experience any difficulty opening a section or link from this page, please email the webmaster.

How to Search this manual:

This edition has three search options.

- Search the whole manual. Open the Complete Manual pane. From your keyboard press the Ctrl and F keys at the same time. A search box will appear. Type in a descriptive or key word (for example "Denials". The search box will show all locations where denials discussed in the manual.

- Search by Chapter. Open any Chapter tab (for example the "Billing Procedures" tab). From your keyboard press the Ctrl and F keys at the same time. A search box will appear. Type in a descriptive or key word (for example "Denials". The search box will show where denials discussed in just that chapter.

- Site Search. Search the manual as well as other documents related to a particular search term on the Montana Healthcare Programs Site Specific Search page.

Prior manuals may be located through the provider website archives.

Nursing Facility and Swing Bed Manual

Updated 04/25/2017

Nursing Facility and Swing Bed Services Manual

To print this manual, right click your mouse and choose "print". Printing the manual material found at this website for long-term use is not advisable. Department Policy material is updated periodically and it is the responsibility of the users to check and make sure that the policy they are researching or applying has the correct effective date for their circumstances.

Update Log

Publication History

This publication supersedes all previous Nursing Facility and Swing Bed Services handbooks. Published by the Montana Department of Public Health & Human Services, January 2005.

Updated January 2011, December 2011, March 2012, October 2016, and April 2017.

CPT codes, descriptions and other data only are copyright 2014 American Medical Association (or such other date of publication of CPT). All Rights reserved. Applicable FARS/DFARS Apply.

Update Log

04/12/2017 Nursing Facility and Swing Bed Services Manual converted to an HTML format and adapted to 508 Accessibility Standards.

10/18/2016 Nursing Facility and Swing Bed Services Manual has been edited and revised in its entirety.

03/05/2012 Notice of Transfer or Discharge added.

12/21/2011 Key Contacts, Covered Services, Billing Procedures, Submitting a Claim, RA, Forms and Definitions amended.

03/03/2011 Entire Manual Revised.

06/08/2010 Appendix A, June 2010: Nurse Aide Certification and Training and Competency Evaluation (Testing) Survey Form added.

End of Update Log Chapter

Table of Contents

Key Contacts and Websites

Introduction

Manual Organization

Manual Maintenance

Rule References

Claims Review (MCA 53-6-111, ARM 37.85.406)

Getting Questions Answered

Covered Services

General Coverage Principles

- Services Within Scope of Practice (ARM 37.85.401)

- Preadmission Screening and Level of Care Determinations (ARM 37.40.101–120

- ARM 37.40.201–207, ARM 37.40.405, and 42 CFR 483.100–138)

- Nurse Aide Requirements (ARM 37.40.322)

- Nurse Aide Registry

- Payment for Nurse Aide Training and Competency Evaluation

- Nurse Aide Cost Reporting (ARM 37.40.322 and ARM 37.40.346)

Coverage Requirements for Nursing Facilities

- Nursing Facility Requirements (ARM 37.40.306)

- Out-of-State Nursing Facility (ARM 37.40.337)

- Staffing and Reporting Requirements (ARM 37.40.315)

- Change in Provider (ARM 37.40.325)

- Personal Resources (ARM 37.40.302)

- Resident Trust Accounts (ARM 37.40.306, MCA 53-6-168, and 42 CFR 483.10(c)

Coverage Requirements for Swing Bed Providers

- Swing Bed Requirements (ARM 37.40.405 and ARM 37.40.408)

- Admission, Transfer, Discharge, and Waiver Requirements (ARM 37.40.405 and ARM 37.40.420)

Bed Hold Days for Nursing Facilities

Covered Services Included in the Daily Rate (ARM 37.40.304, ARM 37.40.305, and ARM 37.40.406)

- Routine Supplies

- Routine Transportation

Covered Services Separately Billable (ARM 37.40.330 and ARM 37.40.406)

- Ancillary Items

- Dental Care

- DME and Medical Supplies

- Pharmacy Items

- Therapy Services

- Transportation

Noncovered Services (ARM 37.40.331 and ARM 37.85.207)

Other Programs

- Mental Health Services Plan (MHSP)

- Healthy Montana Kids Plan (HMK)

Prior Authorization

What Are Prior Authorization, Passport to Health, and Team Care? (ARM 37.85.205 and 37.86.5101–5120)

Prior Authorization

Coordination of Benefits

When Members Have Other Coverage

Identifying Additional Coverage

When a Member Has Medicare

- Medicare Claims

When a Member Has TPL (ARM 37.85.407)

- Exceptions to Billing Third Party First

- Requesting an Exemption

- When the Third Party Pays or Denies a Service

- When the Third Party Does Not Respond

- Blanket Denials

Billing Procedures

Timely Filing Limits (ARM 37.85.406)

Tips to Avoid Timely Filing Denials

Billing for Retroactively Eligible Members (ARM 37.40.202)

When Members Have Other Insurance

When to Bill Medicaid Members Directly (ARM 37.85.406)

Using the Medicaid Fee Schedule

Coding Tips

Member Cost Sharing (ARM 37.85.204 and ARM 37.85.402)

Billing for Services Included in the Daily Rate

- Bed Hold Days

- Medicare Coinsurance Days

Separately Billable Services

- Ancillary Items

- Parenteral/Enteral Nutritional Solutions

- Routine Supplies Used in Extraordinary Amounts

- Other Services

Recording Changes on TADs

Submitting a Claim

The Most Common Billing Errors and How to Avoid Them

Resolving Member Eligibility Problems

Other Programs

Submitting a Claim

MA-3 Form

Turn Around Documents (TADs)

CMS-1500s6.2

Mailing Paper Claims and TADs6.2

Billing Electronically with Paper Attachments

Claim Inquiries

Avoiding Claim Errors

Other Programs

Remittance Advices and Adjustments

How Payment Is Calculated

Nursing Facility and Swing Bed Payment

- Nursing Facility Per Diem Rate (ARM 37.40.307)

- Nurse Aide Training Reimbursement

- Swing Bed Hospital Per Diem Rate (ARM 37.40.406)

- Ancillary Items (ARM 37.40.330)

- Medicare Coinsurance Days (ARM 37.40.307)

Interim Per Diem Rates (ARM 37.40.307 and ARM 37.40.326)

Payment to Out-of-State Facilities (ARM 37.40.337)

Other Programs

Appendix A: Forms

Definitions and Acronyms

Index/How To Search This Manual

End of Table of Contents Chapter

Key Contacts and Websites

Certification for Medical Need

Swing bed hospitals must obtain a certificate of need (CON) from the Quality Assurance

Division (QAD) in order to provide swing bed

services.

(406) 444-2099 Telephone

Send written inquiries to:

Quality Assurance Division

P.O. Box 202953 Helena, MT 59620-2953

Claims

Send paper claims to:

Claims Processing

P.O. Box 8000 Helena, MT 59604

Member Eligibility

Below are common methods for verifying member eligibility.

See the Contact Us page of the Provider Information website for details.

Montana Provider Relations

(800) 624-3958 or (406) 442-1837

FaxBack

(800) 714-0075

Integrated Voice Response (IVR)

(800) 714-0060

Send email inquiries to:

MTPRHelpdesk@conduent.com

Montana Access to Health Web Portal

Drug Prior Authorization

For all questions regarding drug prior authorization, contact Mountain Pacific at:

(800) 395-7961

(406) 443-6002 Helena

8 a.m. to 5 p.m., Monday–Friday (Mountain Time)

Fax documentation to:

(800) 294-1350

(406) 513-1928 Helena

Fraud and Abuse – Member

DPHHS Quality Assurance Division (QAD), Program Compliance Bureau

To report member waste, fraud, and/or abuse, call the Member Fraud Hotline at (800) 201-6308.

Member fraud can include one or more of the following

• Submitted a false application for Medicaid.

• Provided false or misleading information about income, assets, family members, or resources.

• Shared a Medicaid card with another individual.

• Sold or bought a Medicaid card.

• Diverted for resale or other reasons prescription drugs, medical supplies, or other benefits.

• Participated in doctor or pharmacy shopping.

• Obtained Medicaid benefits that they were not entitled to through other fraudulent means.

• Paying cash for controlled substances.

• Forged prescriptions.

Fraud and Abuse – Provider

Montana Department of Justice, Investigations Bureau, Medicaid Fraud Control Unit (MFCU) Section

To report provider fraud or elder abuse, call the Medicaid Provider Fraud Hotline at (800) 376-1115.

The MFCU Section is responsible for investigating any crime that occurs in a healthcare facility, including theft, drug diversion, sexual assault, and homicide. The MFCU Section also investigates elder exploitation, elder abuse, and fraud by providers within the Medicaid system. This may include investigations into doctors, dentists, durable medical equipment companies, mental health providers, and other Medicaid providers.

Lien and Estate Recovery

Providers must give any personal funds they are holding for a Medicaid-eligible resident to the Department within 30 days following the resident’s death.

Telephone

(800) 694-3084 In state

(406) 444-7313 Out of state and Helena

Fax

(800) 457-1978 In state

(406) 444-1829 Out of state and Helena

Send written inquiries to:

Third Party Liability Unit Lien and Estate Recovery DPHHS

P.O. Box 202953 Helena, MT 59620-2953

Nurse Aide Registry

To verify the nurse aide’s certification status:

(406) 444-4980

Send written inquiries to:

Montana Nurse Aide Registry

2401 Colonial Drive, 2nd Floor

P.O. Box 202953 Helena, MT 59620

Point-of-Sale (POS) Help Desk

For assistance with online POS claims adjudication, contact:

Technical POS Help Desk

(800) 365-4944

6 a.m to midnight, Monday–Saturday

10 a.m. to 9 p.m., Sunday (Eastern Time)

Preadmission Screening

For all questions regarding preadmission screening, contact Mountain Pacific at:

Telephone

(800) 219-7035 In/Out of state

(406) 443-0320

Fax

(800) 413-3890 In/Out of state

(406) 513-1921

Provider’s Policy Questions

For policy questions, contact the appropriate division of the Department of Public Health and Human Services. See the Contact Us page of the Provider Information website

Provider Relations

For general Passport or claims questions, or questions about eligibility, payments, or denials:

(800) 624-3958 In/Out of state

(406) 442-1837 Helena

(406) 442-4402 Fax

Send written inquiries to:

Provider Relations Unit

P.O. Box 4936 Helena, MT 59604

Send e-mail inquiries to: MTPRHelpdesk@conduent.com

Secretary of State

The Secretary of State’s office publishes the Administrative Rules of Montana (ARM).

(406) 444-2055 Phone

Secretary of State

P.O. Box 202801 Helena, MT 59620-2801

http://www.sos.mt.gov/ARM/index.asp

Senior and Long Term Care Contact the Nursing Facility Services Bureau for the following:

- Nursing facility or swing bed program information

- Out-of-state nursing facility services

- Admission, transfer, or discharge waivers

- Eligibility or claim issues that cannot be resolved through the county Office of Public Assistance or Provider Relations

- Authorization for services described in the Prior Authorization chapter of this manual

(406) 444-4077 Telephone

(406) 444-7743 Fax

Send written inquiries to:

Nursing Facility Services Bureau Senior and Long Term Care

P.O. Box 4210

Helena, MT 59604-4210

Third Party Liability

For questions about private insurance, Medicare, or other third party liability:

1-800-624-3958 In/Out of state

1-406-443-1365 Helena

1-406-442-0357 Fax

Send written inquiries to:

Third Party Liability

P.O. Box 5838 Helena, MT 59604

EDI Support Unit at Montana Provider Relations

For questions regarding electronic claims submission:

(800) 624-3958 Choose Option 1 or

EDI Unit

Send e-mail inquiries to: MTPRHelpdesk@conduent.com

Mail to:

EDI Support Unit

P.O. Box 4936 Helena, MT 59604

http:edisolutionsmmis.portal.conduent.com/gcro/

EDI Solutions is the EDI clearinghouse. Visit this website for more information on:

- Provider Services

- EDI Support

- EDI Enrollment

- Electronic Transaction Instructions for HIPAA 5010

- Manuals

- Software

Behavioral Health and Developmental Disabilities (BHDD)

https://dphhs.mt.gov/bhdd

• Adult Mental Health Services

• Chemical Dependency Services

• Prevention Resource Center

• Suicide Information and Resources

• Forms and Applications

Montana Healthcare Programs Provider Information

MATH Web Portal

https://mtaccesstohealth.portal.conduent.com/mt/general/home.do

- Montana Healthcare Programs Website: Medicaid provider information including announcements, provider manuals and replacement pages, fee schedules, provider notices, forms, frequently asked questions, preferred drug lists (PDLs), Claim Jumper newsletters, and program contacts and websites.

- Montana Access to Health (MATH) Web Portal: Secure website on which providers can view members’ medical history, verify member eligibility, submit claims to Medicaid, check claim status, verify payment status, and download remittance advice reports.

Montana Department of Public Health and Human Services

https://dphhs.mt.gov/

Services for children, families, senior citizens, health, medical and assistance.

Secretary of State

Administrative Rules of Montana Home Page

http://www.sos.mt.gov/ARM/index.asp

- Secretary of State home page

- Administrative Rules of Montana

Senior and Long Term Care

https://dphhs.mt.gov/SLTC

• What community programs can help me stay independent?

• Where can I find help on living healthy?

• What are my housing or living options?

• Can I get help with protective or legal services?

• How can I get help managing my money?

• Are you a partner or provider of services?

• Questions about Senior and Long Term Care? Contact Us.

• What am I eligible for?

End of Key Contacts and Websites Chapter

Introduction

Thank you for your willingness to serve members of the Montana Medicaid program and other medical assistance programs administered by the Department of Public Health and Human Services.

Manual Organization

This manual provides information specifically for nursing facilities and swing bed providers. Other essential information for providers is contained in the General Information for Providers manual. Providers are responsible for reviewing both manuals.

Information on the services Medicaid covers can be found in the Covered Services chapter, while the instructions on billing for these services are in the Billing Procedures chapter. Billing procedures for members who are covered by both Medicaid and Medicare are in the Coordination of Benefits chapter.

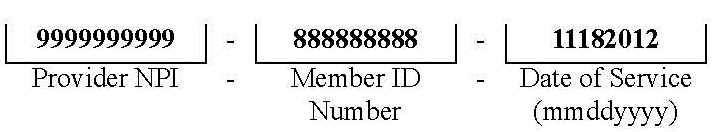

A table of contents and an index allow you to quickly find answers to most questions. The margins contain important notes with extra space for writing notes. There is a list of contacts and websites at the beginning of this manual and additional contacts and websites on the Contact Us page of the Provider Information website. There is space on the inside of the front cover to record your NPI for quick reference when calling Provider Relations.

Rule References

Important: Providers are responsible for knowing and following current Federal and state rules, regulations, and laws.

Providers must be familiar with all current rules and regulations governing the Montana Medicaid program. Provider manuals are to assist providers in billing Medicaid; they do not contain all Medicaid rules and regulations. Rule citations in the text are a reference tool; they are not a summary of the entire rule. In the event that a manual conflicts with a rule, the rule prevails. Links to rules are available on the Provider Information website. Paper copies of rules are available through the Department (Senior and Long Term Care) and the Secretary of State’s office.

In addition to the general Medicaid rules outlined in the General Information for Providers manual, the following rules and regulations are also applicable to the nursing facility and swing bed programs:

• Code of Federal Regulations (CFR)

• 42 CFR 483 – Requirements for States and Long-Term Care Facilities

• 42 CFR 409 – Hospital Insurance Benefits

• 42 CFR 482 – Requirements for Specialty Hospitals (e.g., swing beds)

• 42 CFR 482.66 – Special Requirements for Hospital Providers of Long-Term Care Services

• 42 CFR 488 – Survey Certification and Enforcement Procedure

• 42 CFR 489.100 – Advanced Directives

• Montana Codes Annotated (MCA)

• MCA Title 37, Chapter 9 – Nursing Home Administrators

• Administrative Rules of Montana (ARM)

• ARM 37.40.101–37.40.361 – Nursing Home Care

• ARM 37.40.401–37.40.422 – Swing Bed

Claims Review (MCA 53-6-111, ARM 37.85.406)

The Department is committed to paying Medicaid providers’ claims as quickly as possible. Medicaid claims are electronically processed and usually are not reviewed by medical experts prior to payment to determine if the services provided were appropriately billed. Although the computerized system can detect and deny some erroneous claims, there are many erroneous claims which it cannot detect. For this reason, payment of a claim does not mean that the service was correctly billed or the payment made to the provider was correct. Periodic retrospective reviews are performed which may lead to the discovery of incorrect billing or incorrect payment. If a claim is paid and the Department later discovers that the service was incorrectly billed or paid or the claim was erroneous in some other way, the Department is required by federal regulation to recover any overpayment, regardless of whether the incorrect payment was the result of Department or provider error or other cause.

Getting Questions Answered

The provider manuals are designed to answer most questions; however, questions may arise that require a call to a specific group (such as a program officer, Provider Relations, or a prior authorization unit). The list of contacts at the front of this manual has telephone numbers and addresses pertaining to this manual. The Contact Us page of the Provider Information website includes additional contacts. Medicaid manuals, provider notices, replacement pages, fee schedules, forms, and more are available on the Provider Information website.

End of Introduction Chapter

Covered Services

General Coverage Principles

This chapter provides covered services information that applies specifically to services provided by nursing facilities and swing bed providers. For information on billing for these services, see the Billing Procedures chapter in this manual. Like all healthcare services received by Medicaid members, services rendered by these providers must also meet the general requirements listed in the Provider Requirements chapter of the General Information for Providers manual.

Services Within Scope of Practice (ARM 37.85.401)

Services are covered only when they are within the scope of the provider’s license.

Preadmission Screening and Level of Care Determinations (ARM 37.40.101–120, ARM 37.40.201–207, ARM 37.40.405, and 42 CFR 483.100–138)

All individuals seeking long-term care (e.g., nursing facility or swing bed services) must have a preadmission screening before entering a facility. Preadmission screening and Level of Care reviews are performed by the Department’s contractor.

Preadmission/Level I Screening. This screening is also called Pre-Admission Screening Annual Resident Review (PASARR). Level I screening is the review of a long-term care applicant to identify whether the applicant has a primary or secondary diagnosis or indications of mental retardation or mental illness. If an applicant shows indications of mental retardation or mental illness, a Level II screening is required (see below). If the applicant does not have indications of mental retardation or mental illness, the applicant is approved for long-term care placement. The provider must then request a Level of Care determination in order to be approved for Medicaid reimbursement.

To request a Level I screening, providers mail or fax a completed form DPHHS-SLTC-145 to the Department’s contractor. This form is available on the Forms page of the Provider Information website.

Preadmission/Level II Screening. When applicants have indications of mental retardation or mental illness, the Department’s contractor refers them to either the appropriate regional center or the regional mental retardation authority for a Level II screening. This screening determines whether the applicant requires specialized services and is appropriate for long-term care placement.

IMPORTANT: Level of Care Determination. The Department’s contractor performs a Level of Care determination to assess medical necessity and appropriateness of placement for Medicaid members seeking long-term care services. A Level of Care determination must be completed before Medicaid payment can be authorized. For this reason, the Department recommends that a Level of Care determination be completed for any resident who has even the possibility of becoming Medicaid-eligible. Even if a resident is found to be retroactively eligible for Medicaid, the facility cannot be paid if a Level of Care determination has not been completed. Level of Care and continued-stay reviews are performed regularly to verify medical necessity and skilled or intermediate determinations.

A Level of Care determination must be completed for all Medicaid members and should be done for potential Medicaid members.

To request a Level of Care review, providers mail or fax a completed DPHHS-SLTC-86 to the Department’s contractor. This form is available on the Forms page of the Provider Information website.

The Department’s contractor must receive the request on or before the date the applicant is admitted to the facility. Once the applicant is approved, the provider may bill Medicaid for the services.

Nurse Aide Requirements (ARM 37.40.322)

Under federal regulation, nursing facilities may not employ a nurse aide for more than 4 months, unless the individual completes a state-approved Nurse Aide Training and Competency Evaluation Program (NATCEP) and is certified competent to provide nursing and nursing-related services.

Nursing facilities may employ an individual as a nurse aide for up to 4 months as long as the individual meets one of the following:

- Is a full-time employee enrolled in a state-approved training and competency evaluation program

- Has applied to complete the competency evaluation program

- Has demonstrated competence for all nursing tasks to be performed by participating in such a program

Anyone who wants to be employed in a nursing facility as a nurse aide must successfully complete a NATCEP and become a certified nurse aide (CNA). Nurse aide training programs in Montana are offered by nursing facilities, community colleges, adult education programs, and independent contractors.

Nurse Aide Registry

Federal regulation requires the state to establish and maintain a registry of all individuals who successfully complete a NATCEP or CEP. This registry is maintained by the Quality Assurance Division (QAD) and is used by nursing facilities to verify the nurse aide’s certification status. The names of individuals who have successfully completed the competency evaluation are reported to QAD by the testing program. QAD also documents findings of abuse, neglect, or misappropriation of property by nurse aides on the registry.

Nurse aides are recertified every 2 years. Sixty days before their certification expires, nurse aides receive a recertification application from QAD, which must be completed and returned in a timely manner. The application asks for verification that the nurse aide has met the minimum work requirement for recertification (at least one 8-hour shift within the 24-month period). Nurse aides who have not performed paid nursing or nursing-related services for a continuous period of 24 consecutive months since completing a NATCEP must complete a new NATCEP or CEP. If a nurse aide fails to return the recertification application, he/she will lose certification and must complete a new NATCEP or CEP to be recertified.

Payment for Nurse Aide Training and Competency Evaluation

Nursing facilities are required to pay for nurse aide’s certification training and testing costs when the aide is employed by the facility or has an offer of employment by the facility on the date he/she begins a NATCEP. Medicaid reimburses these costs to the facility through the facility’s per diem rate. (See Nurse Aide Training Reimbursement in the How Payment Is Calculated chapter of this manual). Federal regulations explicitly prohibit NATCEPs or CEPs from charging a nurse aide for costs associated with training and testing when the aide has an offer of employment from or is employed by a nursing facility. Additionally, federal regulations require that a nurse aide who becomes employed or who is offered employment within 12 months of completing a NATCEP or CEP be reimbursed for training and testing costs.

The nursing facility may determine which NATCEP or CEP program the nurse aide in its employ attends. If a nurse aide chooses to attend another program without the facility’s consent, then the facility is not required to reimburse costs incurred by the nurse aide. The nurse aide has the option to have the competency evaluation conducted at the facility in which the nurse aide is or will be employed.

The first nursing facility that employs or offers an aide employment within 12 months of the aide completing a NATCEP or CEP is required to reimburse the nurse aide for training and testing costs. The facility may provide this reimbursement of costs over a reasonable period of time (about 6 months) while the individual is employed as a nurse aide and stop payment if the nurse aide ceases to be employed. The nursing facility may require the nurse aide to work for a period of time before reimbursement begins, but not more than 6 months.

If the nurse aide leaves the facility before qualifying for full reimbursement, the nursing facility must partially reimburse the nurse aide. The partial reimbursement should be based on the percentage of the qualifying period that the nurse aide is actually employed. For example, if a facility uses a 180-day qualifying period and the nurse aide terminates employment after 90 days, then the facility must reimburse the nurse aide for half of the aide’s training and testing costs.

Facilities should develop written policies specifying how nurse aides will be reimbursed for training and testing costs. These policies should describe the facility’s qualifying period, if any, and the method of reimbursement, if necessary. Facilities should inform their nurse aides of these policies at the time of hiring. It is recommended that nurse aides retain receipts for their training and testing costs to present to the nursing facility for reimbursement.

Nurse Aide Cost Reporting (ARM 37.40.322 and ARM 37.40.346)

IMPORTANT: Nursing facilities can only report training and testing costs for nurse aides who are employed on either a full-time or part-time basis as nurse aides.

The initial training and testing costs are tracked by the Senior and Long Term Care Division on a quarterly basis through the Nurse Aide Certification/ Training and Competency Evaluation (Testing) Survey. This report does not include costs associated with in-service or ongoing CNA training, only the certification training and testing. Nursing facilities are required to file the survey each quarter to report their training and testing costs. If a facility did not have any training or reimbursement to CNA employees for their training outside of the facility during the quarter, the facility must file a report stating that fact.

The facility should report costs for recertification tests. Medicaid does not distinguish between tests taken for initial certification and tests taken in order to regain certification. If a nurse aide is not successful in passing the certification tests, the facility should report the costs for subsequent tests. The nurse aide has three opportunities within a quarter to complete the testing successfully, and Medicaid will allow the cost for all three attempts.

The facility is not required to reimburse a CNA for recertification testing if the CNA allowed certification to lapse, but the facility may choose to in order to hire and/or retain the CNA.

For each quarter of the state fiscal year (July 1–June 30), the Senior and Long Term Care Division will send out a letter and a survey form with the instructions on how to complete the form. Complete this form and return it within the given deadline for reporting. Each facility must complete and return this report quarterly, whether there are expenses to report or not. If a provider fails to submit the quarterly reporting form within 30 calendar days following the end of the quarter, the Department may withhold reimbursement payments. If the provider fails to submit the required information within the time frame, the Department will withhold 10% of the reimbursement for the month following the deadline. If the information is not received the following month, 20% will be withheld, and for the third and subsequent months the entire reimbursement will be withheld. Withheld funds will be returned to the provider upon receipt of the completed survey.

Coverage Requirements for Nursing Facilities

The following are coverage requirements for nursing facilities.

Nursing Facility Requirements (ARM 37.40.306)

Nursing facilities must meet all of the following requirements:

- Comply with applicable laws, rules, and regulations. (See the Provider Requirements chapter in the General Information for Providers manual.)

- Maintain current licensure in the state in which the facility is licensed.

- Maintain Medicaid certification.

- Maintain a current agreement with the Department to provide the Level of Care that the facility is billing for.

- Operate under the direction of a licensed nursing facility administrator or other qualified supervisor according to laws, rules, and regulations.

- Have admission policies that comply with nondiscrimination laws and regulations and do not discriminate on the basis of diagnosis or handicap. (See the Non-Discrimination section in the Provider Requirements chapter of the General Information for Providers manual.)

- Must give the Department 30 days’ advance written notice to terminate Medicaid enrollment.

- It is the provider’s responsibility to provide appropriate transfer and/or discharge planning for Medicaid residents and to care for them until appropriate transfers or discharges are completed, regardless of the facility’s planned termination date.

- Providers terminating Medicaid enrollment must prepare and file a closeout cost report that covers the end of the provider’s previous fiscal year through the date of termination. New providers assuming operation from a terminating provider must enroll in the Medicaid program.

-

Notify Medicaid residents (or their representative) of a transfer or discharge. Providers must follow transfer regulations according to 42 CFR 483.12. The Transfer Discharge form located on the Provider Information website can be used, or providers can use their own form as long as it contains all of the following information:

- Reason for transfer or discharge.

- Effective date of transfer or discharge.

- The location to which the resident is transferred or discharged.

- A statement that the resident has the right to appeal the action to the state and information on how to appeal.

- The name, address and phone number of the state long-term care ombudsman.

- For residents who are disabled or mentally ill, the mailing address and telephone number of the agency responsible for the protection of and advocacy for these individuals.

Out-of-State Nursing Facility (ARM 37.40.337)

Medicaid may cover services for Montana residents seeking services from out-of-state providers. Out-of-state providers must obtain authorization from the Department before providing services. Out-of-state services may be authorized when one or more of the following criteria is met:

- The resident’s health would be endangered if he/she were to return to Montana for medical services. The medical emergency must be documented.

- The required services are not provided in Montana.

- The required services are less costly out of state than in Montana.

- The resident is a child for whom Montana provides adoption or foster care assistance.

- The Department has determined that it is general practice for members in the resident’s locality to use medical resources located in another state.

To request authorization for out-of-state nursing facility services, providers must contact the Senior and Long Term Care Division and have the following information available:

- The resident’s full name, Medicaid ID number, and expected date of admission.

- A physician’s orders describing the reason for placement and the expected duration of the stay.

Upon approval, providers are given additional instructions on requirements for providing services to the Montana resident. In addition to meeting the requirements described under the Coverage Requirements for Nursing Facilities and Nursing Facility Requirements sections earlier in this chapter, out-of-state providers must also supply the Department with the following information:

- Copy of current license to operate as a nursing facility in the state in which the facility is located.

- Copies of documents from the facility’s state Medicaid agency establishing or stating the Medicaid per diem rate for the resident’s Level of Care during the period services are provided.

- Copy of the certification notice from the facility’s state survey agency showing certification for Medicaid services.

- Assurances that the facility is not operating under Medicare or Medicaid sanctions during the period services are provided.

Staffing and Reporting Requirements (ARM 37.40.315)

Important: Providers must submit a complete and accurate Nursing Facility Staffing Report to the Department monthly using the online nursing home staff report website.

Nursing facility staffing levels must meet federal law, regulations, and requirements. Providers must submit a complete and accurate DPHHS-SLTC-015 Nursing Facility Staffing Report to the Department monthly using the Department’s online Staffing Report Website.

The completed form must be submitted by the 10th of the following month (e.g., January’s report must be submitted by February 10). The Department may withhold all Medicaid payments from the provider until this requirement is met. A sample form and instructions are found on the Nursing Facility Provider Type Page of the Provider Website.

Change in Provider (ARM 37.40.325)

When a facility experiences a change in provider, ownership, or management, the provider must supply the Department with 30 days’ advance written notice of the change and file closeout cost reports. The new owner/management must obtain a new National Provider Identifier (NPI) and enroll in Medicaid.

The following are considered a change in provider. See the Definitions and Acronyms chapter in this manual for a description of related party and unrelated party.

- All Providers. An unrelated party acquires:

- The provider’s title or interest or a leasehold interest in the facility.

- The right to control and manage the facility’s business.

- Sole Proprietorship Providers. The entire sole proprietorship is sold to an unrelated party, and the seller does not retain a right of control over the business.

- Partnership providers.

- A new partner acquires an interest in the partnership greater than 50%. The new partner is not a related party to either a current partner or a former partner.

- The new partner is not a related party to either a current partner or a former partner from whom the new partner acquired all or any portion of the new partner’s interest and the current or former partners from whom the new partner acquires an interest do not retain a right of control over the partnership arising from the transferred interest. A new Medicaid provider ID is required.

- Corporate Providers. An unrelated party acquires stock and the associated stockholder rights representing an interest of more than 50% in the provider’s corporation.

Personal Resources (ARM 37.40.302)

Important: Resident trust funds are subject to the same auditing procedures as other nursing facility records.

Personal resources (patient contribution) is the total of all the resident’s income from all sources available to pay for the cost of care, less the resident’s personal needs allowance. Personal needs allowance is money used for the resident’s personal expenses. It cannot be used for items included in the facility’s per diem rate or separately billable supplies (e.g., routine nursing expenses, transportation charges for physician visits). Providers may contact the local office of public assistance for a determination of the member’s personal resources. Personal needs allowances are based on income sources and are as follows:

Personal Needs Allowance

Income Source Monthly Allowance

Supplemental Security Income (SSI) only $30.00

Retirement or Social Security or both $50.00

VA reduced pension $90.00

Providers must retain resident trust accounts for residents who request them. Providers who maintain resident trust accounts:

- Must ensure that these funds are used only for those purposes stated in writing by the resident (or legal representative).

- Must maintain personal funds in excess of $50 in an interest bearing account and must credit all interest earned to the resident’s account.

- Must allow the resident convenient access to personal funds up to $50.

- May not borrow funds from these accounts or commingle resident and facility funds.

- Must notify the resident when total funds and assets (to the extent of the facility’s knowledge) are within $200.00 of the resource limit for Medicaid eligibility. The facility must also notify the resident that he/she may lose Medicaid benefits if resources exceed that limit.

Following the death of a resident who has received Medicaid benefits at any time, any of the resident’s personal funds that a provider is holding must be turned over to the Department. The provider may first receive payment from the account for items usually billed to member, and the remainder must be issued to the Lien and Estate Recovery Unit within 30 days. (See the Key Contacts and Websites chapter in this manual.)

If a facility is not aware of a deceased resident ever having received Medicaid benefits, all personal monies held by the facility should be disbursed according to Montana probate laws and regulations (MCA, Title 72, Chapters 1–3).

Coverage Requirements for Swing Bed Providers

The following are coverage requirements for swing bed providers.

Swing Bed Requirements (ARM 37.40.405 and ARM 37.40.408)

Swing bed providers must meet all of the following requirements. The Department may terminate a provider’s enrollment if the facility is not in compliance with requirements.

- Comply with applicable laws, rules, and regulations. (See the Provider Requirements chapter in the General Information for Providers manual.)

- Be a licensed hospital, critical access hospital (CAH), or licensed medical assistance facility that is Medicare-certified to provide swing bed hospital services (42 CFR 482.66).

- Maintain Medicaid certification and provide requested documentation for continued enrollment.

- Have fewer than 49 hospital beds. The hospital bed count is determined by excluding from the total licensed hospital beds newborn and intensive care beds, beds in a separately certified nursing or skilled nursing facility, beds in a distinct part of the facility such as a psychiatric or rehabilitation unit, and beds which are not consistently staffed and utilized by the hospital.

- A CAH with swing bed approval has no more than 25 acute care inpatient beds, of which no more than 15 are used for acute care at any one time for providing inpatient care.

- Be located in a rural area of the state. A rural area is an area which is not designated as “urbanized” by the most recent official census.

- Have a certificate of need (CON) from the state DPHHS to provide swing bed hospital services. To obtain a CON, contact the Department’s QAD.

- Must not have in effect a 24-hour nursing waiver.

- Must not have had its Medicare or Medicaid swing bed certification or approval terminated within two years prior to applying for enrollment as a Medicaid swing bed hospital services provider.

- Protect the rights of each resident as described in 42 CFR 483 and ARM 37.40.416.

- Provide for an ongoing program of activities designed to meet the interests and the physical, mental, and psychosocial well-being of each resident as defined in ARM 37.40.412.

- Provide medically-related social services to attain or maintain the highest practicable physical, mental and psychosocial well-being of each resident as described in ARM 37.40.412.

Admission, Transfer, Discharge, and Waiver Requirements (ARM 37.40.405 and ARM 37.40.420)

Important: Members who are covered by Medicare and Medicaid are subject to transfer requirements as soon as Medicaid becomes a payer. See the Coordination of Benefits chapter.

Swing bed hospital providers must meet all of the following requirements.

- Before admitting a Medicaid resident to its swing bed facility, the hospital must obtain a prescreening by the Department’s contractor. The screening determines the Level of Care required by the member’s medical condition.

- The hospital must determine that no appropriate nursing facility bed is available to the Medicaid member within a 25-mile radius of the swing bed hospital.

- The hospital must maintain written documentation of inquiries to nursing facilities about the availability of a nursing facility bed. The hospital must indicate to the nursing facility that if a bed is not available, the hospital will provide swing bed services to the member. The swing bed hospital is encouraged to enter into availability agreements with Medicaid participating nursing facilities in its geographic region that require the nursing facility to notify the hospital of the availability of nursing facility beds and dates when a bed will be available.

- A Medicaid member admitted to a swing bed must be discharged to an appropriate nursing facility bed within a 25-mile radius of the swing bed hospital within 72 hours of an appropriate nursing facility bed becoming available. To ensure that residents are sufficiently prepared and oriented when discharged to a nursing facility, the swing bed hospital must inform residents of the transfer requirement upon admission.

- Swing bed providers may request a waiver of the 25-mile transfer requirements for their acute care members under certain conditions. The waiver should be requested within the 72-hour period to assure the facility can bill Medicaid for services. The member’s attending physician must verify in writing that the member’s condition would be endangered by transfer to an appropriate nursing facility or that the individual has a medical prognosis that his or her life expectancy is 6 months or less if the illness runs its normal course. The Senior and Long Term Care Division must receive the waiver request and physician’s verification within 5 working days of admission to the swing bed hospital or within 5 days of availability of an appropriate nursing facility bed. Approval must be obtained before billing Medicaid for the services.

- When the facility anticipates discharge, a resident must have a discharge summary that includes all of the following:

- A recapitulation of the resident’s stay.

- A post-discharge plan of care that is developed with the participation of the resident and family, which will assist the resident to adjust to the new living environment.

- A final summary of the resident’s status to include the following:

- Medically defined conditions and prior medical history

- Medical status measurement

- Physical and mental functional status

- Sensory and physical impairments

- Nutritional status and requirements

- Special treatments or procedures

- Mental and psychosocial status

- Discharge potential

- Dental condition

- Activities potential

- Cognitive status

- Drug therapy

Important: Members who are covered by Medicare and Medicaid are subject to transfer requirements as soon as Medicaid becomes a payer. See the Coordination of Benefits chapter.

Important: A Medicaid member admit ted to a swing bed must be discharged to an appropriate nursing facility bed within a 25-mile radius of the swing bed hospital within 72 hours of an appropriate nursing facility bed becoming available.

Important: Waiver approvals are granted by county offices

Bed Hold Days for Nursing Facilities

Medicaid covers bed hold days when a nursing facility is holding a bed for a resident who is temporarily away from the facility. Medicaid does not cover bed hold days for swing bed providers. These services require authorization. For instructions on obtaining authorization for these services (including required forms), see the Prior Authorization chapter in this manual.

- Hospital Hold Days. Hospital holds days are days when the provider holds a bed for a resident who is temporarily receiving medical services outside the facility other than another nursing facility. Facilities must obtain authorization before billing Medicaid for these services. Medicaid covers hospital hold days under the following circumstances:

- All Medicaid-certified beds in the facility are occupied or being held for a resident who is either on a therapeutic home visit or who is receiving temporary medical services elsewhere, except in another nursing facility, and is expected to return.

- The facility has a current waiting list of potential residents for each bed day claimed for reimbursement.

- The resident’s hospitalization is temporary, and he/she is expected to return to the facility.

- The cost of holding the bed is less costly than the cost of extending the hospital stay until an appropriate long-term care bed would otherwise become available.

- Therapeutic Home Visits (THV). Medicaid covers an accumulative total of 24 days of therapeutic home visits in a fiscal year (July 1–June 30). See the Prior Authorization chapter in this manual for details on the requirements for THVs.

- Visits of 72 Hours or Less. Providers must complete a monthly form when a resident is spending at least overnight but not more than 72 hours (3 days) at home. Prior authorization is not required, but the form must be submitted to the Department within 90 days from the first day of leave.

- Unexpected Delay. If a resident on a THV of 72 hours or less is unexpectedly delayed, the facility must obtain telephone authorization in order to bill for the visit. As soon as the facility is notified that the resident will not return within the 72 hours or if the resident does not return when expected, the facility must call for authorization. If this occurs after business hours or on a weekend or holiday, the facility must call for authorization on the next working day or the entire visit will be denied.

- Visits Over 72 Hours. Prior authorization is required for therapeutic home visits over 72 hours.

Important: If prior authorization is not obtained for visits over 72 hours, payment for the entire visit will be denied.

Covered Services Included in the Daily Rate (ARM 37.40.304, ARM 37.40.305, and ARM 37.40.406)

The following coverage rules apply to nursing facilities and swing bed providers unless otherwise stated. These services are included in the facility’s per diem rate and may not be billed separately to Medicaid.

Routine Supplies

The nursing facility per diem rate includes (but is not limited to) the following:

- Use of facility, equipment, and a room.

- All general nursing services including the administration of oxygen and medication, hand feeding, incontinence care, tray service, nursing rehabilitation services, enemas, and routine pressure sore/decubitus treatment.

- Personal hygiene items and services such as the following:general nursing services including the administration of oxygen and medication, hand feeding, incontinence care, tray service, nursing rehabilitation services, enemas, and routine pressure sore/decubitus treatment.

- Dietary services including dietary supplements used for tube feeding or oral feeding (e.g., straws and tubes for drinking). For sole source parenteral or enteral nutritional services, please refer to the Ancillary Items section in the Billing Procedures chapter of this manual.

- Laundry services, except for residents’ clothing that is dry cleaned outside of the facility.

- Personal hygiene items and services such as the following:

- Bathing items (e.g., towels, washcloths, soap)

- Hair care items (e.g., shampoo, brush, comb)

- Incontinence care and supplies (e.g., incontinence pads)

- Nail care items

- Shaving items (e.g., razors, shaving cream)

- Skin care and hygiene items (e.g., lotions, ointments, hand and bacteriostatic soaps, specialized cleaning agents to treat special skin problems or fight infection)

- Tooth and denture care items (e.g., toothpaste, toothbrush, floss, denture cleaner and adhesive, denture cups)

- Waste bags.

- Other miscellaneous items (e.g., cotton balls, swabs, deodorant, hospital gowns, sanitary napkins, facial tissues, paper towels, safety pins)

- First aid and medical supplies such as the following:

- Antibacterial/bacteriostatic solutions, including betadine, hydrogen peroxide, 70% alcohol, merthiolate, zepherin solution

- Cotton

- Enema equipment and/or solutions

- Finger cots

- Gloves (sterile and unsterile)

- Hypodermic needles (disposable and non-disposable)

- Ice bags

- Medication dispensing cups and envelopes

- Antibacterial ointments

- Sterile water and normal saline for irrigating

- Supplies necessary to maintain infection control (e.g., supplies required for isolation-type services)

- Surgical tape and dressings

- Suture removal kits

- Swabs (including alcohol swab)

- Syringes (disposable/non-disposable hypodermic; insulin, irrigating)

- Thermometers, clinical

- Tongue blades

- Wound-cleaning beads or paste

- Over-the-counter medications (or their equivalents):

- Acetaminophen (regular and extra-strength)

- Aspirin (regular and extra-strength)

- Cough syrups

- Therapeutic Class 1 and Class 6 antacids and laxatives (e.g., milk of magnesia, mineral oil, suppositories for evacuation (dulcolax and glycerine), maalox, mylanta)

- Nasal decongestants and antihistamines

- Reusable items and equipment such as the following:

- Baths, whirlpool and sitz

- Bathtub accessories (e.g., seat, stool, rail)

- Beds, mattress, linens, sheepskins and other fleece type pads, and bedside furniture

- Bedboards, foot boards, cradles

- Bedside equipment (e.g., bedpans, urinals, emesis basins, water pitchers, serving trays)

- Bedside safety rails

- Blood-glucose testing equipment

- Blood pressure equipment and stethoscope

- Canes, crutches

- Cervical collars

- Commode chairs

- Enteral feeding pumps

- Geriatric chairs

- Heat lamps (e.g., infrared lamps)

- Humidifiers/vaporizers (steam)

- Isolation cart

- IV poles

- Mattress (foam-type and water)

- Patient lift apparatus

- Physical examination equipment

- Postural drainage board

- Raised toilet seats

- Suction machines

- Tourniquets

- Traction equipment

- Trapeze bars

- Walkers (regular and wheeled)

- Wheelchairs (standard)

Routine Transportation

Nonemergency routine transportation (visits to physicians, pharmacy or other medical providers or routine outings) is the responsibility of the nursing facility when the destination is within 20 miles of the facility.

Covered Services Separately Billable (ARM 37.40.330 and ARM 37.40.406)

The following coverage rules apply to nursing facilities and swing bed providers unless otherwise stated. Providers of following services may bill Medicaid separately from the facility’s per diem rate. Some of these services require prior authorization. For more information on requesting prior authorization, see the Prior Authorization chapter in this manual.

Ancillary Items

The following are coverage rules for ancillary items. A list of these items with prior authorization indicators is available on the nursing facility/swing bed fee schedule, which is available on the Nursing Facility Provider Type Page in the Fee Schedule Pane. Some ancillary items with special criteria include the following:

- Oxygen. Medicaid covers oxygen concentrators and portable oxygen units (cart, E tank, and regulators) only when the following requirements are met and prior authorized. (See the Prior Authorization chapter in this manual.) Medicaid does not cover maintenance costs.

- The provider must submit documentation of the cost and useful life of the concentrator or portable oxygen unit, and a copy of the purchase invoice to the Department.

- The provider must maintain a certificate of medical necessity stating the PO2 level or oxygen saturation level for each resident. The resident’s physician must sign and date the certificate. The criteria must meet or exceed Medicare’s. The Department will recover inappropriate payments if the certificate is not available upon request.

- Parenteral/Enteral Nutritional Solutions. Parenteral/enteral nutritional solutions are covered only when the following requirements are met:

- The solutions are the sole source of nutrition

- The solutions are medically necessary and appropriate

- The services have been prior authorized. (See the Prior Authorization chapter in this manual.)

- Routine Supplies Used in Extraordinary Amounts. Routine nursing supplies used in extraordinary amounts may be covered if they are prior authorized. (See the Prior Authorization chapter in this manual.)

Dental Care

Facilities must assist residents in obtaining routine and 24-hour emergency dental care. This includes helping to make dental appointments, arranging for transportation, and promptly referring residents with lost or damaged dentures to a dentist. Dental services are billed to Medicaid by the dentist or denturist providing the service. (See the Dental and Denturist Program manual.)

DME and Medical Supplies

Certain durable medical equipment (DME) and supplies are included in the nursing facility per diem rate. However, when a resident has a condition that requires supplies not provided under nursing facility services, these items may be separately billable by the DME provider in accordance with DME service delivery requirements. (See the Durable Medical Equipment, Orthotics, Prosthetics and Supplies manual.)

Pharmacy Items

Prescribed medications, including flu shots, tine tests, and IV solutions are not included in the per diem rate and must be billed separately by the pharmacy providing the services in accordance with pharmacy service delivery requirements. (See the Prescription Drug Program manual.)

Therapy Services

Medicaid covers physical, occupational, and speech therapies that are not considered part of routine nursing facility services. Maintenance therapy is included in the nursing facility’s daily rate, but restorative therapy services are provided and billed separately by a licensed therapist in accordance with therapy service delivery requirements. See the Therapy Services manual, which includes physical therapy, occupational therapy, and speech therapy, for billing procedures.

Transportation

Medicaid may cover transportation costs separately billable to Medicaid in one of the following circumstances:

- When a resident is wheelchair-bound or requires transport by stretcher

- When a resident must travel farther than 20 miles to a Medicaid-covered appointment

- When a resident requires emergency transportation by ambulance

The facility must be enrolled with Medicaid as a transportation provider and follow policy and billing instructions in the Commercial and Specialized Non-Emergency Transportation manual. Another option is to utilize an approved transportation provider.

Noncovered Services (ARM 37.40.331 and ARM 37.85.207)

Some services are not covered by Medicaid and may be billed directly to the resident. The resident must be informed in advance that they will be charged for these items and the amount of the charge. The following items are included:

- Gifts purchased by resident.

- Social events and entertainment outside the scope of the provider’s activities program.

- Cosmetic and grooming items and services that Medicare and Medicaid do not cover (e.g., beauty shop services).

- Television, radio and private telephone rental.

- Less-than-effective drugs (exclusive of stock items).

- Vitamin and mineral supplements.

- Personal reading material.

- Personal clothing.

- Flowers and plants.

- Privately hired nurses or aides.

- Specially prepared or alternative food requested by the resident instead of food generally prepared by the facility.

- The difference between the cost of items usually reimbursed under the per diem rate and the cost of specific items or brands requested by the resident which are different from that which the facility routinely stocks or provides (e.g., special lotion, powder, diapers).

- Personal comfort items (e.g., tobacco products and accessories, notions, novelties, and confections).

- Personal dry cleaning.

- Private rooms that are not medically necessary. Medicaid pays the same rate for private rooms as double occupancy rooms. If a private room is medically necessary, the facility may not bill the resident for the difference between the amount Medicaid pays and the amount of the room. If the resident requests a private room but it is not medically necessary, the facility may bill the resident for the difference. Before providing the service, the facility must clearly inform the resident that he or she must pay extra for the private room and the resident will no longer have a private room when payment stops.

Important: If a private room is medically necessary, the facility may not bill the resident for the difference.

Other Programs

Mental Health Services Plan (MHSP)

The information in this manual does not apply to the Mental Health Services Plan (MHSP). Members who qualify for MHSP may receive mental health services during nursing facility care. For more information on the MHSP program, see the mental health manual available on the Provider Information website or call (406) 444-3964.

Healthy Montana Kids (HMK) Plan

The information in this manual does not apply to HMK members. For an HMK medical manual, contact Blue Cross and Blue Shield of Montana. Additional information regarding HMK is available on the HMK website.

End of Covered Services Chapter

Prior Authorization

What Are Prior Authorization, Passport to Health, and Team Care? (ARM 37.86.5101–5120 and 86.53.03)

Prior authorization, Passport to Health, and the Team Care program are examples of the Department’s efforts to ensure the appropriate use of Medicaid services. In most cases, providers need approval before services are provided to a particular member. Nursing facility and swing bed residents are not enrolled in Passport or Team Care, so Passport approval is not required for nursing services. Prior authorization, however, is required for some services as described in the following section. For more information on Passport and Team Care, see the Passport to Health provider manual on the Provider Information website's Passport information page.

Occasionally a nursing facility claim will deny for lack of Passport approval. This happens when a Passport member enters a facility during a month when his/her Passport enrollment is still active. When this happens, call Provider Relations and ask them to begin the process to force the claim.

Prior Authorization

Important: Medicaid does not pay for services when prior authorization requirements are not met.

Some services require authorization before billing Medicaid, and other services require prior authorization before the service is provided. When seeking authorization, keep in mind the following:

- The following table lists services that require authorization, who to contact, and documentation requirements.

- Authorization requirements apply to both nursing facility and swing bed providers, except for hospital hold days and therapeutic home visits, which are not benefits for swing bed providers.

- Have all required documentation included in the packet before submitting a request for authorization See the following table for documentation requirements.

- Once prior authorization is granted for ancillary services, providers will receive notification containing a prior authorization number. This prior authorization number must be included on the claim form. See the Submitting a Claim chapter 6 in this manual.

- All forms required for authorization are located on the Provider Information website Forms Page.

- If authorization is not granted for services that require authorization, Medicaid will not pay for the service or may recover unauthorized payments.

Authorization Criteria for Specific Services

Service: Oxygen Concentrator

Requirements:

Documentation includes the following and must be maintained in the provider’s records:

- Resident’s name and Medicaid ID number

- Provider name and provider’s NPI

- A certificate of medical necessity, signed and dated by the resident’s physician, stating the PO2 level or oxygen saturation level. The criteria must meet or exceed Medicare’s. If the certificate is not available upon request, inappropriate payments may be recovered

- Cost and useful life of the concentrator or portable oxygen unit and a copy of the purchase invoice

- Period of coverage being requested (authorizations are reevaluated at least quarterly)

Once approved, providers will receive an authorization number that must be included on the claim.

For more information on oxygen concentrators, see the Covered Services chapter in this manual.

Contacts:

Nursing Facility Services Senior and Long Term Care

P.O. Box 4210

Helena, MT 59604

Telephone

(406) 444-3997

(406) 444-4077

Fax

(406) 444-7743

Service: Parenteral/Enteral Nutritional (PEN) Solutions

Requirements:

Documentation includes the following and must be maintained in the provider’s records:

- Resident’s name and Medicaid ID number

- Provider name and provider’s NPI/API.

- Copy of a current signed and dated physicians’ order

- Period of coverage being requested (authorizations are reevaluated at least quarterly)

- Name of solution

- Total projected monthly usage (quantity, cans) and acquisition cost (dollar amount). The cost must be documented by a receipt or bill.

- Procedure code for the solution

- A Medicare EOMB or denial must be attached if resident is covered by Medicare

Once approved, providers will receive an authorization number that must be included on the claim form.

For more information on parenteral/enteral nutritional solutions, see the Covered Services chapter in this manual.

Contacts:

Nursing Facility Services Senior and Long Term Care

P.O. Box 4210

Helena, MT 59604

Telephone

(406) 444-3997

(406) 444-4077

Fax

(406) 444-7743

Service: Routine Supplies Used in Extraordinary Amounts

Requirements:

Documentation includes the following and must be maintained in the provider’s records:

- Resident’s name and Medicaid ID number

- Provider name and provider’s NPI/API.

- Copy of a current signed and dated physicians’ order

- Period of coverage being requested (authorizations are reevaluated quarterly)

- Type of supplies used in extraordinary amounts

- Quantity used (itemize each item individually)

- Cost of item documented on invoice

- Dollar amount being requested

Upon approval, providers will receive an authorization number that must be included on the claim.

For more information on routine supplies used in extraordinary amounts, see the Covered Services chapter in this manual.

Contacts:

Nursing Facility Services Senior and Long Term Care

P.O. Box 4210

Helena, MT 59604

Telephone

(406) 444-3997

(406) 444-4077

Fax

(406) 444-7743

Service: Hospital Hold Days (Nursing Facility Only)

Requirements:

Facility must be full with a waiting list. Documentation

includes the following:

- For authorization, submit DPHHS-SLTC-052,

- Request for Nursing Facility Bed Reservation

- During Resident’s Temporary Hospitalization form monthly. The Department must receive this form within 90 days from the day the resident leaves the facility. The form is located on the Forms page of the Provider Information website.

- Copy of facility waiting list

For more information on requesting hospital hold days, see the Bed Hold Days section of the Covered Services chapter in this manual.

Contacts:

Nursing Facility Services Senior and Long Term Care

P.O. Box 4210

Helena, MT 59604

Telephone

(406) 444-3997

(406) 444-4077

Fax

(406) 444-7743

Service: Authorization Criteria for Specific Services Therapeutic Home Visits (Nursing Facility Only)

Requirements:

Visit of 72 Hours or Less

Prior authorization is not required; however, DPHHS-SLTC-041, Therapeutic Home Visit Reservation, must be completed monthly.

The Department must receive the form within 90 days from the day a resident leaves the facility. If the form is not received within 90 days, the Department will recover any unauthorized payment.

Unexpected Delay

If a resident on a THV of 72 hours or less is unexpectedly delayed, the facility must obtain phone authorization from the Department to bill for the visit. As soon as the facility is notified that the resident will not return with the 72 hours, or if the resident does not return when expected, the facility must call for authorization. If this occurs after business hours or on a weekend or holiday, the facility must call for authorization on the next working day or the entire visit will be denied.

The facility must complete DPHHS-SLTC-042, Request for Bed Reservation for Therapeutic Home Visit in Excess of 72 Hours, and submit it to the Department within 90 days of the first day of the visit.

Visits Over 72 hours

Prior authorization is required for therapeutic home visits over 72 hours before the resident leaves the facility. If insufficient time is available to obtain authorization by mail, the facility may receive verbal authorization by calling the Department. The facility must complete DPHHS-SLTC-042, Request for Bed Reservation for Therapeutic Home Visit in Excess of 72 Hours, and submit it to the Department within 90 days from the day the resident leaves for the visit.

Form DPHHS-SLTC-042 must be approved and signed by the Department to receive payment. If the form is not received within 90 days, the Department will recover any unauthorized payment.

The following forms are available on the Provider Information website.

- DPHHS-SLTC-041, Therapeutic Home Visit Reservation

- DPHHS-SLTC-042, Request for Bed Reservation for Therapeutic Home Visit in Excess of 72 Hours

Medicaid will not pay the facility for more than 24 days of therapeutic home visits in a fiscal year (July1-June 30).

For more information on requesting therapeutic home visits, see the Bed Hold Days section of the Covered Services chapter in this manual.

Contacts:

Nursing Facility Services Senior and Long Term Care

P.O. Box 4210

Helena, MT 59604

Telephone

(406) 444-3997

(406) 444-4077

Fax

(406) 444-7743

End of Prior Authorization Chapter

Coordination of Benefits

When Members Have Other Coverage

Medicaid members often have coverage through Medicare, workers’ compensation, employment-based coverage, individually purchased coverage, etc. Coordination of benefits is the process of determining which source of coverage is the primary payer in a particular situation. In general, providers should bill other carriers before billing Medicaid, but there are some exceptions. See Exceptions to Billing Third Party First in this chapter. Medicare is processed differently than other sources of coverage.

Identifying Additional Coverage

The member’s Medicaid eligibility verification may identify other payers such as Medicare or other third party payers. (See the General Information for Providers manual, Member Eligibility and Responsibilities chapter.) If a member has Medicare, the Medicare ID number is provided. If a member has additional coverage, the carrier is shown. Some examples of third party payers include:

- Private health insurance

- Employment-related health insurance

- Workers’ compensation insurance*

- Health insurance from an absent parent

- Automobile insurance*

- Court judgments and settlements*

- Long-term care insurance

*These third party payers (and others) may not be listed on the member’s eligibility verification.

Providers should use the same procedures for locating third party sources for Medicaid members as for their non-Medicaid members. Providers cannot refuse service because of a third party payer or potential third party payer.

When a Member Has Medicare

Medicare claims are processed and paid differently than other non-Medicaid claims. The other sources of coverage are called third party liability (TPL), but Medicare is not.

Medicare Claims

Medicare Part A covers skilled nursing services for the first 100 days following a qualifying inpatient hospitalization. Any claims for services covered by Medicare must be submitted to Medicare before submitting to Medicaid. After Medicare processes the claim, an Explanation of Medicare Benefits (EOMB) is sent to the provider, and the provider can then bill Medicaid.

When a Medicaid resident is also covered by Medicare and returns to a nursing facility or swing bed hospital following a qualifying inpatient hospital stay, and the resident continues to qualify for skilled level of care, Medicaid may assist with Medicare coinsurance for days 21 through 100. Services through the first 100 days must be billed to Medicare first, but days 101 and following may be billed directly to Medicaid. (See the Medicare Coinsurance Days section in the Billing Procedures chapter of this manual.) See the following table for more examples of when to bill Medicare or Medicaid first.

Who to Bill First by Service

Bill Medicare First For These Services

- The first 100 days of skilled nursing facility care following a resident’s qualifying inpatient hospitalization

- Parenteral/enteral feeding solutions

- Some ancillary services (i.e. Physical Therapy, Occupational Therapy) for the first 100 days of skilled nursing facility care.

Bill Medicaid First for These Services

- The 101st and remaining days following a resident’s qualifying inpatient hospitalization

- Nonqualifying inpatient hospitalization (i.e., less than three days)

- Oxygen

- Some ancillary services (ARM 37.40.330) for the 101st and remaining days

- Bed hold days

- Nonemergency transportation provided by the facility that is over 20 miles from the facility

When submitting electronic claims with paper attachments (e.g., EOMB), see the Billing Electronically with Paper Attachments section of the Submitting a Claim chapter. When submitting a claim with the EOMB, use Medicaid billing instructions and codes. Medicare’s instructions, codes, and modifiers may not be the same as Medicaid’s. The claim must also include the provider’s NPI and the Medicaid member’s ID number.

When a Member Has TPL (ARM 37.85.407)

Providers are required to notify their members that any funds the member receives from third party payers, when the services were billed to Medicaid, must be turned over to the Department. The following words printed on the member’s statement will fulfill this obligation: "When services are covered by Medicaid and another source, any payment the member receives from the other source for the Medicaid covered service must be turned over to Medicaid."

Important: Exceptions to Billing Third Party First

When a Medicaid member is also covered by Indian Health Service (IHS), providers must bill Medicaid first. IHS is not considered a third party liability.

If the third party has only potential liability, the provider may bill Medicaid first. Do not indicate the potential third party on the claim. Instead, send the claim and notification to the Third Party Liability unit.

Requesting an Exemption

Providers may request to bill Medicaid first under certain circumstances. In each of these cases, the claim and required information should be sent directly to the Third Party Liability unit.

- When a provider is unable to obtain a valid assignment of benefits, the provider should submit the claim with documentation that the provider attempted to obtain assignment and certification that the attempt was unsuccessful.

- When the provider has billed the third party insurance and has received a nonspecific denial (e.g., no member name, date of service, amount billed), submit the claim with a copy of the denial and a letter of explanation.

- If another insurance has been billed, and 90 days have passed with no response, submit the claim with a note explaining that the insurance company has been billed or with a copy of the letter sent to the insurance company. Include the date the claim was submitted to the insurance company and certification that there has been no response.

Important: If the provider receives a payment from a third party after the Department has paid the provider, the provider must return the lower of the two payments to the Department within 60 days.

When the Third Party Pays or Denies a Service

When a third party payer is involved (excluding Medicare) and the other payer:

- Pays the claim. Indicate the amount paid when submitting the claim to Medicaid for processing.

- Allows the claim, and the allowed amount went toward member’s deductible. Include the insurance explanation of benefits (EOB) when billing Medicaid.

- Denies the claim. Submit the claim and a copy of the denial (including the reason explanation) to Medicaid.

- Denies a line on the claim. Bill the denied lines together on a separate claim and submit to Medicaid. Include the EOB from the other payer and an explanation of the reason for denial (e.g., definition of denial codes).

When the Third Party Does Not Respond

If another insurance has been billed, and 90 days have passed with no response, bill Medicaid as follows:

- Submit the claim with a note explaining that the insurance company has been billed, or include a copy of the letter sent to the insurance company.

- Include the date the claim was submitted to the insurance company.

- Send this information to the Third Party Liability unit.

Blanket Denials

Providers who routinely bill for Medicaid covered ancillary services that other insurance companies do not cover may request a blanket denial letter. Providers may complete a Request for Blanket Denial Letter and submit the form to the Third Party Liability unit. The TPL unit usually requests the provider send an EOB showing the services have been denied by the member’s other insurance company. The provider is then notified that the services have been approved for a blanket denial.

Providers who bill electronically (ANSI ASC X12 837 transactions) will receive a memo from the TPL unit with a tracking number for use when billing Medicaid. This number must be included in the paperwork attachment indicator field when billing electronically for the specific services.